“Di minimus” sounds so fancy. It’s a Latin term meaning about minimal things. According to the IRS, a di minimus benefit is

one for which, considering it’s value and the frequency with which it is provided, is so small as to make accounting for it unreasonable or impractical.

According to the IRS website, an item over $100 could not be considered to be di minimus, but they haven’t actually given us an exact number of what is considered to be di minimus which makes things a little foggy. Is it $99? That’s probably pushing it. There’s an article by the Bradford Tax Institute that suggests $50-$70. I feel like that’s a pretty decent guideline.

I really like the di minimus fringe benefits rules because it gives me a little more room to work. If I’m buying a business gift, I’m limited to spending $25 per family for the entire year. Check out my post about What Business Gifts Can I Deduct on My Tax Return here. But if I’m buying something for one of my employees, I can use the di minimus rules and spend a little more.

What counts as di minimus fringe benefits?

- Occasional snacks, coffee, donuts

- Holiday gifts

- Occasional tickets for entertainment events

- Flowers, fruit, books etc. provided under special circumstances

- Occasional parties or picnics

- Occasional meal money or travel expenses for working overtime

- Group term life insurance with a face value of not more than $2,000

- Personal use of a cell phone provided by the employer primarily for business

What can never be di minimus?

Gift cards, gift certificates and cash – no matter how small the amount is. If you give a “gift” to an employee of cash, a gift certificate or a gift card, it must get included in her wages as W2 income. Not only will your employee pay income tax on the gift, but there will also be social security and medicare taxes as well.

What makes the di minimus fringe benefits so cool?

Well for one thing, they are tax deductible to the employer. As an employer, that always makes me happy. And, they are tax free to my employees, and that makes them happy. It’s a win-win for us all. And I’m not limited to the $25 a year gift rule. I can buy my employees birthday gifts, holiday gifts, and just “Hey, you’re awesome!” gifts, as long as it’s occasional and not being used to replace their income. Let’s get real here, flowers and candy will never replace a decent wage, you’ve got to do that first. But an occasional gift to tell them that they’re awesome on top of a decent wage? That’s a winner!

And those flowers, fruit baskets and books? The di minimus rules aren’t just for your employees, you can also give them to your corporate directors, independent contractors, partners in a partnership and even yourself!

The other really cool thing is that you can give your employees tickets to an entertainment event. Under the new tax law, entertainment isn’t deductible any more – but as a di minimus fringe benefit it is. You can’t give away season tickets, but you can give away tickets to a single show.

The IRS doesn’t give us a whole lot of guidance on these di minimus fringe benefits. They use the term “occasional” a whole lot without ever defining how often occasional is. The IRS uses the term “facts and circumstances” so I would think flowers for a funeral or a hospital gift for an illness would pass muster. And IRS Pub. 15-B specifically mentions birthday and holiday gifts so that should be okay too.

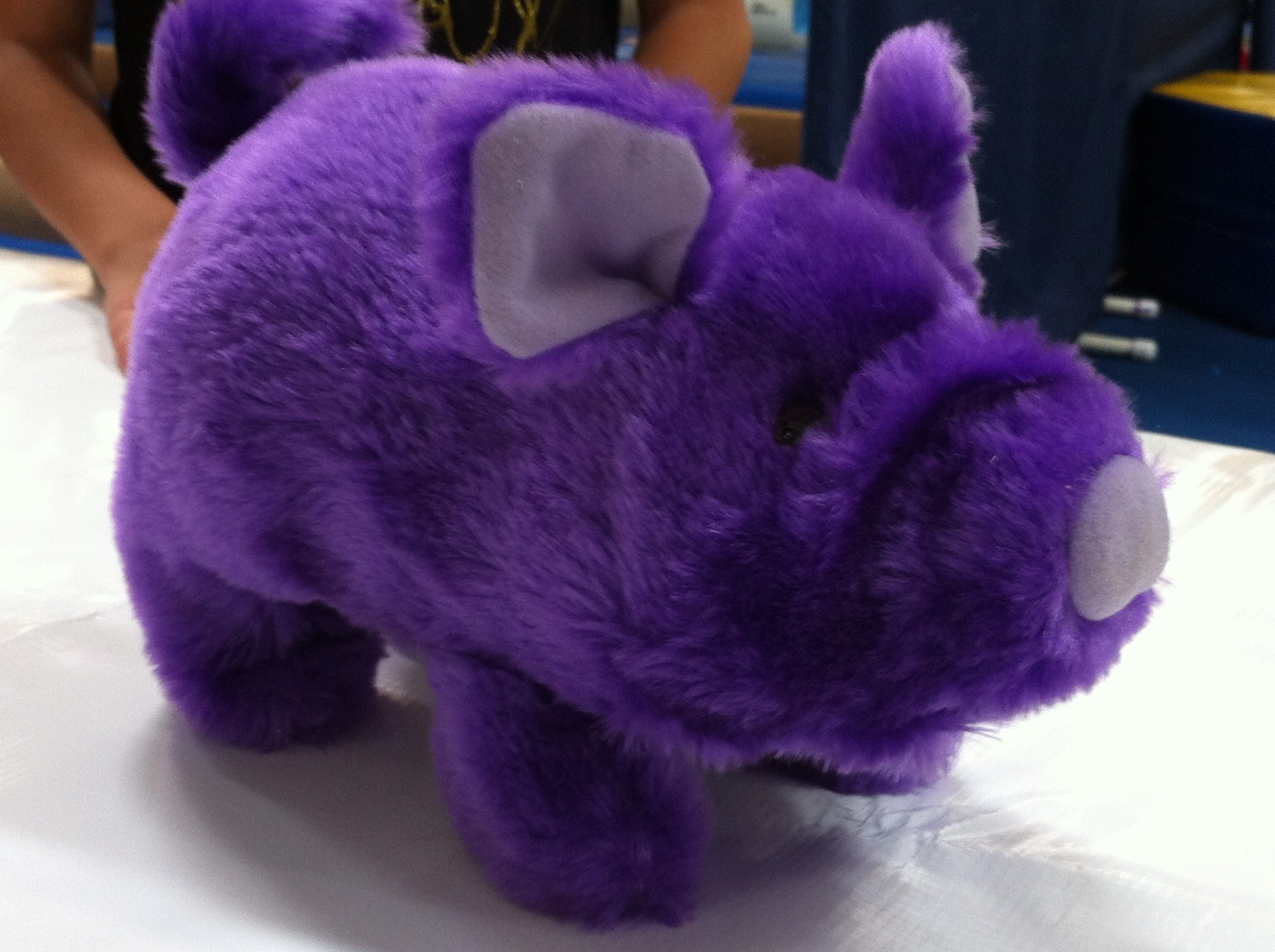

You may have heard the old saying, “Pigs get fed, hogs get slaughtered.” Do take advantage of the di minimus fringe benefit rules, just don’t abuse them.