You’ve heard those commercials on the radio or seen them on late night television. “Settle your debt with the IRS for pennies on the dollar!” Those companies charge a lot of money for something called an “Offer in Compromise.” I’ve dealt with a lot of people who’ve paid between $5,000 and $8,000 for those services and gotten nothing-NOTHING for their money. That’s good money they could have used to pay off their debt!

So, before you spend that kind of money, you should see if you have a fighting chance at getting an Offer in Compromise (OIC) first. And here’s the best part–you can test it out for free. FREE!

The IRS has an Offer in Compromise Pre-Qualifier. It’s a wonderful little tool that will let you know if you even have a shot at an OIC before you spend money trying to get one. Here’s the link: IRS Offer In Compromise Pre-Qualifier

The first page has some pretty basic questions. Are you currently filing for bankruptcy? The answer has to be no, you can’t have an OIC if you’re in bankruptcy. If you’re in bankruptcy, you’ll have to wait until that’s over to file for an OIC. The next question is have you filed all of your tax returns. You have to say yes–otherwise the result will be no OIC. You’ll have to file those returns before filing for OIC, but you’re just trying to figure out if you could qualify in the first place.

Same thing with making your tax payments. Before you file for OIC, you’ll have to have your estimated payments caught up for the current year and self employed people must have their payroll deposits made.

So, just to get past the first page, you need to answer NO, YES, NA, NA. If that’s not true, you’ll need to rectify the situation, but you need to answer that way just to get past that screen to get to the meat of the program.

The next page is about where you live and the amount of tax that you owe. (This is one good reason why you need to file all of your returns before you make an offer–how can you settle your debt when you don’t know how much you owe?) But this is just a pre-qualifier, it’s to see if you may be able to make an offer so make your best guess.

The reason they ask about where you live is because the cost of living is different in different areas. A New Yorker will be able to claim more in housing expenses than someone from St. Louis because the cost of living is higher there. On the flip side, New Yorkers don’t get an adjustment for their other expenses which can hurt them when trying to qualify for an OIC. But that’s why the question about where you live is on the pre-qualifier.

This page also asks about your age. If you’re over 65, they make a higher allowance for your out of pocket medical expenses. That’s why that question is there.

From there, on the next page the IRS is looking at your equity–what are you worth financially? How much money do you have in the bank? What’s the value of your home? How big is the loan on it? How much is in your 401(k)? Do you have any stocks? How about the value of your car? How much do you still owe on your car loan? So where it asks for the equity in your car, it means what is the value right now minus how much you still owe on your car loan, that’s your car equity.

Home owners with a lot of equity and people with retirement assets often lose out right here. If you have assets, the IRS figures you can sell them or cash them in to pay your IRS debt. Be honest when filling this out (remember, no one is going to see it but you.) If you apply for an OIC, the IRS will be able to substantiate everything you say, so you may as well tell the truth to yourself on the pre-qualifier.

If your assets are too high to qualify for an OIC, the pre-qualifer will stop right here. You may want to double check your figures before giving up completely, but most likely you’ll need to pursue a different route to get settled with the IRS.

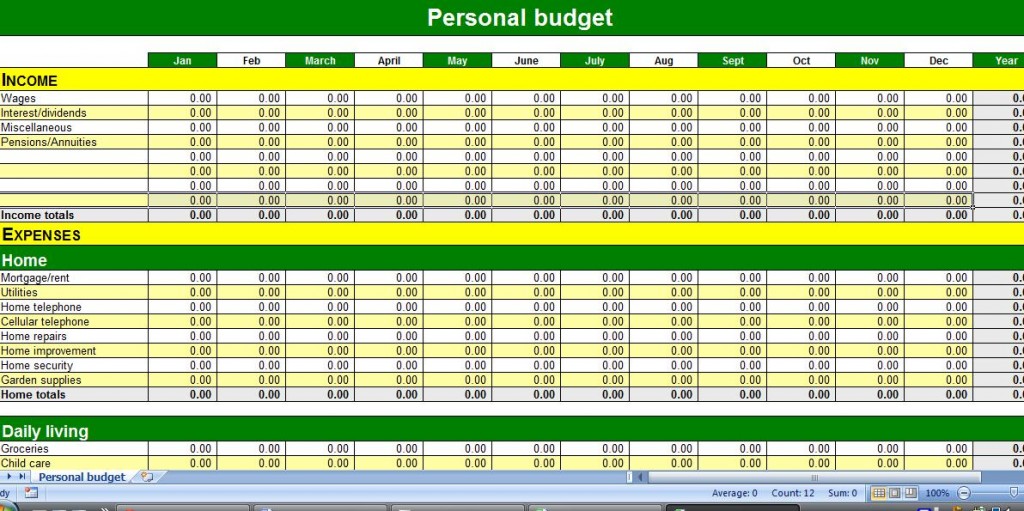

If you do get to the next section it’s all about your income. Wages, interest, dividends, child support, alimony, distributions from partnerships and S corporations. Anything else? The IRS doesn’t care if it’s taxable income or not. They include social security, pension income and even Veterans benefits as being money that you can use to pay your tax debt with.

The IRS is looking for monthly figures here. So, let’s say you get paid every two weeks. That means 26 paychecks a year. You’ll take the gross on your pay stub multiply that by 26, and divide by 12 to get your monthly pay. Lots of people would just double their pay check, because for the most part, you’re getting 2 checks a month. But the IRS doesn’t count that it way. They multiply by 26 and divide by 12 it makes a difference. You need to know how they’re calculating if you want to win this game.

The next page is all about your expenses. How much is your rent or mortgage? How much do you pay on your cars? What do you spend on gas and groceries? Child care? Child support? Alimony? Utilties?

Life insurance is on the list too. Now what they mean here is term life insurance. A whole life policy where it’s like an investment isn’t considered to be a cost of living expense, but term life is.

So now you’ve input your income, your expenses, your debt and your equity and the IRS computer runs all these numbers together and either says you may or may not qualify for an Offer in Compromise. It will also say what the IRS expects your offer to be given the information you put in.

Here’s the thing: the IRS tool is only as good as the information you put in. Most people do the IRS Pre-Qualifier the first time around just guessing at the answers. (I think I’d get this much if I sold my house today, I’m guessing my loan balance is about $x.xx.) This is just to get a ballpark. To get a better picture, you’re going to want to really know what your home loan balance is. Check out the fair market value of your house on Zillow.com. Really look at what you spend for your utilities. Get the actual numbers off your pay stub and do the pre-qualifier again with the actual figures.

Does it still look like you can do this? Great. Remember, page one? Make sure all of your returns are filed first and you know how much debt you owe. Don’t be in bankruptcy. And most importantly, make sure that if you need to be making estimated tax payments, you’re caught up with making them. Make sure these issues are taken care of before you submit an actual offer. I suggest hiring a professional to do this, but if you’re going to do it yourself, start with the Offer in Compromise Booklet, here’s the link to that: Offer in Compromise Booklet

And if you don’t qualify for an Offer in Compromise? That’s still not the end of the world. If you have exceptional circumstances, like huge medical expenses, you may still be able to make an OIC. Be aware that your chances are significantly lower for getting accepted, but you can still make the offer. But you’re going to have to demonstrate that your circumstances are exceptional and that paying the tax would create an undue hardship. This seems silly, but I cannot stress this enough–simply not wanting to pay your tax is not considered an undue hardship. (I get asked that question all the time.) Paying for chemotherapy treatment for a cancer patient, that might get you somewhere.

Even if you cannot qualify for an OIC, you can still work out a payment arrangement with the IRS to get the debt handled. You’re just going to have to pay the full amount of your debt.

If you have the time, please answer a question about this blog post. The following link will take you to my little two question survey. Thanks. Survey

The deadline is coming up, you’ve done your tax return and you’ve got a balance due. Problem is: you don’t have the cash to pay. What can you do?

The deadline is coming up, you’ve done your tax return and you’ve got a balance due. Problem is: you don’t have the cash to pay. What can you do?