At first blush, you might think that advertising and charity don’t go together at all. But when you own a small business, your advertising and charity might just go hand in hand. Let me explain.

When you own a small business, you’ll get lots of calls from organizations wanting your business to make donations to charities. When you’re a sole proprietor, partnership, or S Corporation, your charitable donations don’t reduce your business income, they only count as a charity donation on your Schedule A personal tax return.

So—let’s say you want to donate $100 to Cystic Fibrosis from your business. That’s all fine and good, but that donation doesn’t reduce your business income by $100. It doesn’t reduce your business income by anything at all. You still get to deduct it on your Schedule A—but if you don’t itemize your deductions, that $100 donation doesn’t help your tax return at all.

This is where advertising comes in. Instead of just donating $100 to a charity, you can buy an ad in a charity event program, that way you’re giving money to the charity, and getting a 100% business write-off for the advertising. The charity still gets your money, and you get a better write-off.

Why do you want to your business donation to be advertising? The taxes! If you have a sole proprietorship and you’re in the 25% tax bracket, your business income is actually taxed at 40.3%. (25% regular tax rate plus 15.3% self employment tax.) If you itemize your deductions, your $100 donation would really only cost you $75 (but only if you can itemize your donations.) But if you can count it as a business expense, then your $100 donation would really only cost you $59.70. ($100 minus $40.30) See why this is a good thing?

Of course, there are some things that are just going to be charitable donations no matter how you try to align them. Your tithe or temple dues simply won’t count as advertising. But when you’re looking at charities that you like to support, be sure to check out the advertising opportunities.

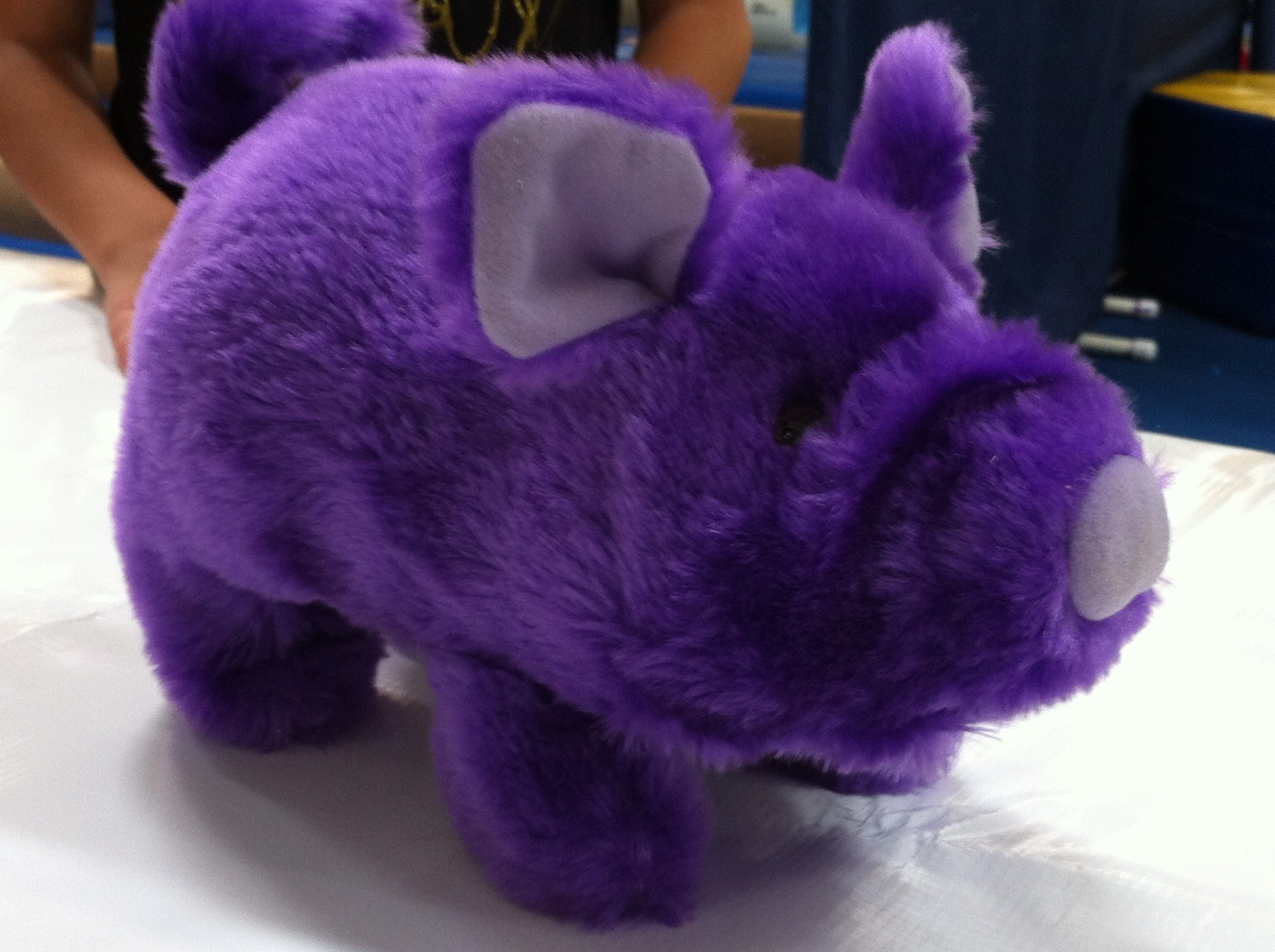

So what’s with the purple pig? A not for profit I support held an event for kids. Instead of just donating money, I got to set up a booth and hand out my fliers to the parents. The pig was part of a pig race game for the kids. The pig is a 100% deductible business expense—and he’s really cute. Cute and deductible—that works for me.