Why doesn’t my QuickBooks balance match my bank balance?

Whenever you issue checks to vendors, there is no saying how long it will take the vendor to deposit the check into their bank account. This represents a “timing difference”. For instance, if you issue a check on March 29th, and the vendor doesn’t deposit the check until June 29th (For whatever reason) there is a significant timing difference between when this check was entered into your accounting software and when it effectively hits the bank statement. Timing differences are the main reason why your QuickBooks balance doesn’t match your actual bank balance and they happen quite frequently.

Your QuickBooks balance, assuming you are on top of your data entry duties, is a more accurate picture of your bank balance alone as it takes into account the floating checks and already subtracts that cash from the bank account balance. It also accounts for deposits in transit (deposits that have not yet hit the bank statement). Timing differences won’t exist however, if your checks and deposits clear within the final days of the month.

The goal of a reconciliation is not to find the discrepancy between your accounting software balance and your bank balance because of timing differences. These are normal discrepancies. The goal is see if this discrepancy is a result of error from the accounting system or error from the bank (Yes-sometimes the banks screw up too!)

Think of it as a way to verify that your cash from your company books is consistent with your bank statement records. Since the ability to acquire and obtain cash is the beating heart to any business, small or large, the cash account, or multiple cash accounts deserve specific attention. The phrase “Cash is King” has been merited all these years with great reason.

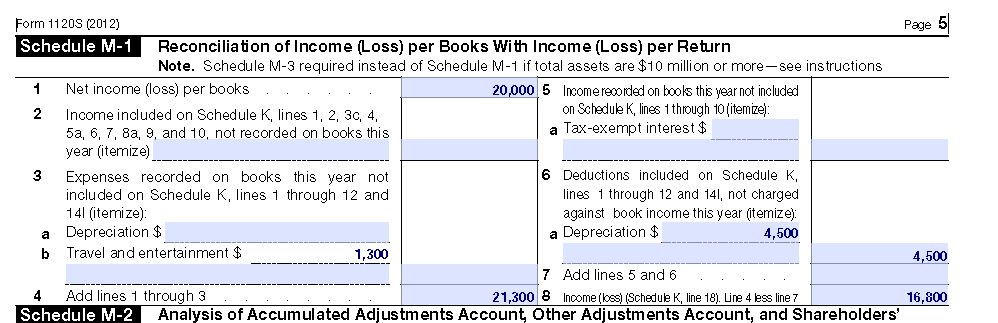

The Bank Statement Formula

Consistent with any bank statement is the formula used to determine how we get to the ending balance from the beginning balance. The formula is stated below:

= Beginning Balance

+ Deposits and other Credits

– Withdrawals and other Debits

– Checks

– Service charges

= Ending Balance

This is the formula that is being used to determine the reconciliation difference.

Reasons to do bank reconciliations

- Internal control – tracking the inflows and outflows of cash is crucial in determining if someone with check writing authority is abusing their power.

- Determining if there are missing transactions—the bank reconciliation helps determine that all of your cash transactions are in your accounting system.

- To see if companies are taking advantage of you—Sometimes humans make mistakes and might run your card twice on accident but sometimes it’s no accident.

- Discovering bank errors or accounting software data entry errors

- To give a true accurate depiction of the money in your bank account. For example, take a property management company. They may manage properties in Florida, California, Missouri, and Illinois. With hundreds of checks being written and mailed, it is absolutely crucial to know what checks are still outstanding because these vendors can deposit the check at any time. Some vendors take months to deposit checks (I’ve seen it before and I’ll see it again.)

So there you have it. Now that you know why you should do a bank reconciliation, read my next post about how to do a bank reconciliation.