A big part of my business is helping people who are getting audited by the IRS. What you might find surprising is how many people I wind up helping that paid a “professional” to prepare their tax returns. I use the term professional loosely here because right now, basically anybody with a computer can hang out a sign and say they are a tax professional.

Now the IRS tried to put a stop to that, they set up rules requiring testing and training for anyone getting paid to prepare tax returns. But they lost a court case so now you’re stuck trying to guess if your preparer has even minimal competency.

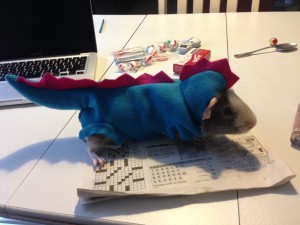

One of the questions I ask when reviewing an audit return is, “How old is your tax person?” Full disclosure here, I’m also “over a certain age”—let’s just leave it at that. Lots of tax professionals are older. (At the IRS convention in Chicago this summer, we made a game of looking for people who were under 40—not many to be found.) But the dinosaurs are the ones who don’t keep up with the new tax laws.

True story: a woman came into my office because she was being audited and the IRS wanted a few thousand dollars from her. She had had her return done by a “professional” but he didn’t do audits so she found me on the internet. Red Flag 1: if your “professional” won’t represent you on a tax return that he’s prepared then he’s probably not credentialed.

Anyway, I took a look at the return and asked her a few questions. By the time I got to, “How old is your tax preparer?” I already knew the answer. He was a retired CPA. He just did tax returns during the season to keep busy.

I handed back the tax return and told her to pay the money. The tax return had been prepared using 2004 tax rules. Had the return been done in 2004—fine, but since it was her 2010 taxes, everything was different. Here’s the real kicker—had she done her own taxes using Turbo Tax or some other home style software—she wouldn’t have made that mistake. The software questions would have guided her to the right answers and she never would have claimed a deduction that she wasn’t allowed.

There are lots of mature tax preparers (I’m one of them) who keep up their licenses, take update classes and keep up with what’s new in tax law. The tax dinosaurs, on the other hand, are living in the past and can cause more harm than good for their clients. Here are some warning signs that you’ve got a dinosaur:

1. Your preparer won’t e-file your tax return. Any professional tax preparer that prepares over 10 tax returns a year is required to e-file the returns. If you have a “normal” tax return and you still have to mail it—that’s a warning sign that your person is behind the times.

2. Your preparer doesn’t use tax software. I don’t care how brilliant the person is—software is necessary for today’s tax returns. Software isn’t perfect, but it eliminates many mistakes.

You should also beware of preparers who won’t sign your return and don’t have PTIN numbers. That’s not necessarily a dinosaur, that’s more likely fraud—you should run from those guys.

Dinosaurs are extinct. The one time the IRS tried to do the right thing and protect people from the tax dinosaurs, they lost the court case. So you have to protect yourself. Tax dinosaurs should be extinct too.