Every year at tax time, I have clients who want me to help them compute their tithe so they can plan their charitable giving for the upcoming year. You would think that computing your tithe would be fairly easy – it’s just 10% of your income. But sometimes, computing your income for tithe purposes isn’t as easy as it seems.

Before I begin, let me do the quick and easy calculations first. For some people, your tithe is based on your take home pay. If your paycheck says $200 – then boom, take $200 times 10% and you get $20 for your tithe. It’s a pretty easy tithe calculation.

For some people, they want to compute their tithe on their before tax dollars. It’s a little trickier. You’ll actually need to see your pay stub and look at your gross income before taxes and other deductions. So maybe the gross pay is actually $250 on the paycheck – so the tithe would be $25. ($250 times .10) The key here is that you have to find your gross pay on the stub first.

But if you’re retired or have investment income, then computing your tithe can be a little more difficult. Those are the people who usually ask me to figure it out for them. This is what I’ve come up with while working with some of my clients who base their tithe on their entire income.

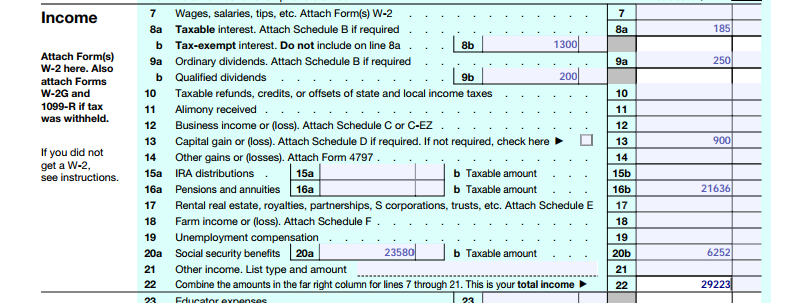

First, we start with the tax return. I’ve put a sample return below so that you can follow along.

Here’s a sample federal tax return that we’ll use to determine total income for computing someone’s tithe.

Start with line 22 – that shows the total income. In this example, we’re looking at $29,223. But $29,233 isn’t really all of this person’s income.

Look at line 8b – you see that she has $1300 of non-taxable interest income. So if we want to compute how much she really makes, we need to add that back in.

Now look at line 20a – the full amount of her social security income is $23,580. If you look at line 20b, you’ll see that only $6,252 of it was taxed. So the difference also needs to get added back into the income. $23,580 minus $6,252 is $17,328.

So, in this example, you’re going to take the total income from line 22, plus the non-taxable interest from line 8a, plus the difference between the taxable and total social security income on line 20 to figure your total income for computing your tithe. It looks like this:

line 22 + line 8a + (line 20a – line 20b) = actual total income

$29,233 + $1,300 + $17,328 = $47,861

So if you take the $47,861 times 10 percent, you get a tithe of $4,786. That’s a whole lot more than if you just used your total income figure from line 22.

FAQS

What about lines 15 and 16 – the IRA and pension distributions? That depends. If you have a portion of your pension distribution that isn’t taxable – (like you have with social security) you would add the difference in the same way you added the difference in with your social security. But if you merely did a non-taxable rollover, then you shouldn’t include that as income for the purposes of your tithe because you’re just moving your retirement funds around.

What about line 9b, qualified dividends? What should we do with them? Nothing. Qualified dividends are included in the number on line 9a so you’ve already counted them. You don’t need to add them again.

What you choose to donate and how you choose to donate is between you and God. This is just a guideline based upon some of my client’s preferences on how they determine their tithing. You may wish to consult with your own church leaders for guidance. There is no IRS rule about tithing amounts, although your tithe may be a deduction on your federal income tax.