If you have over $10,000 USD in a foreign bank account, you are required to report it to the Internal Revenue Service.

The IRS changed how FBARs are filed. It’s now done online instead of mailing a paper form to Detriot. Here’s a step by step guide to help you through it.

Now before you start, I get a lot of questions from people asking if they even need to file an FBAR. Here’s a link to the IRS website that compares whether you need to file an FBAR or a form 8938. I like this comparison list better than most of the documents about whether you need to file or not. It’s easier to understand in my book. So if you’re unsure, look here before you file: http://www.irs.gov/Businesses/Comparison-of-Form-8938-and-FBAR-Requirements

The first thing is to find the website page. Here’s the link: http://bsaefiling.fincen.treas.gov/main.html

When you open the page it says BSA E-Filing System, Financial Crimes Enforcement Network. If you’re a normal human being, and you see the “financial crimes enforcement network” you’re going to think you’re in the wrong place! You’re at the right page. And no, you’re not a criminal. By some weird luck of the draw, the financial crimes division is in charge of FBAR filing. Personally I think they should change the name but the IRS isn’t taking my suggestion on that.

As an individual, you’re going to want to select the top box, Report Foreign Bank Accounts (FBAR).

This will take you to the next screen where you can choose whether to prepare or submit your FBAR. We’ll start with preparing.

When you click on the “Prepare FBAR” link, you should get a download of the input document. But, you might get this instead:

If your download doesn’t convert from the “please wait” page, you’ll probably have to download a newer version of Adobe reader.

If your download doesn’t convert from the “please wait” page, you’ll probably have to download a newer version of Adobe reader.

[Geeky technical issue: my computer had real problems opening this file. I got around it by downloading the NFFBAR to my computer and then opening the file from there. This might work for you if you’re also having trouble.]

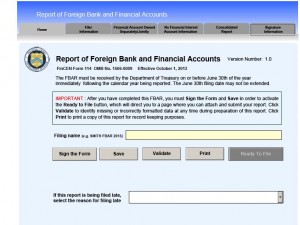

The screen you want to see looks like this:

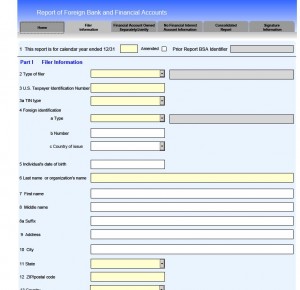

The first thing you’re going to do is name your file so that you can find it again. I’m choosing Roberg FBAR 2013. Next, you’re going to click on the Filer Information tab. You’ll see a screen like this:

That’s going to have all of your personal information, your name, social security number and address. If you don’t have a social security number or ITIN number, then you can use your foreign identification such as a passport number. When you’re done with this section, go to the next tab: Report of Foreign Bank and Financial Accounts.

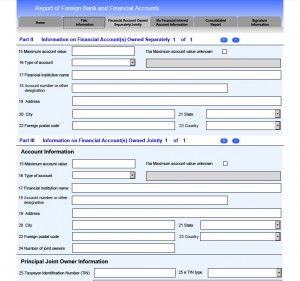

That’s the meat of the reporting form. This is where you put your bank account numbers, the maximum value of your accounts and where they are located. These are accounts that you actually own either by yourself or jointly with your spouse.

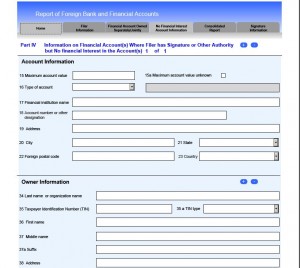

For accounts that you only have a signature authority over, that’s on the next page. It is as follows:

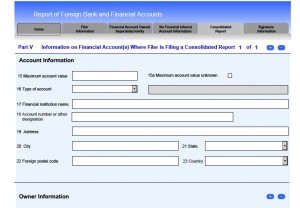

Now this looks pretty similar to the “consolidated account” form as well:

So just make sure you’re on the right screen when you’re filling out the form.

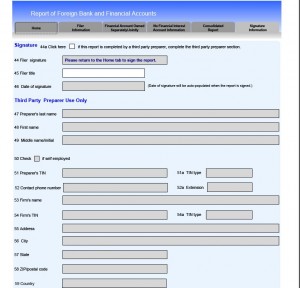

The last page is for the signature date – or, if your tax preparer is doing this for you, that’s the part that she fills out. If you’re doing this yourself, you don’t need to fill out the title on a personal account and the signature date will auto populate when you put the signature on the front page.

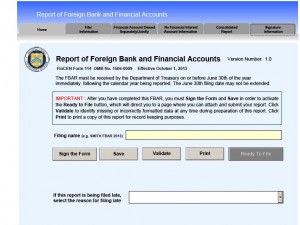

Once you’re done, you’re going to go back to the original screen.

Before you actually hit the signature button, you’ll want to hit the validate button. It will check for errors and omissions for you to correct. Then you’ll want to sign the form and save it. Be sure to print your form, and then when you’re all set click on the ready to file button.

That will put you into a final screen where you’re going to put your email address so you can receive confirmation about your filing. After you submit, you’ll receive a confirmation notice. Later, you should receive an email saying that the BSA has accepted the FBAR.

You want to get your FBAR filed by April 15th. The old date used to be June 30th, but the IRS changed that back in 2016. For those of you who are filing back FBARS, you’ll need to answer the question about why you’re late. If you’re filing on time, just leave that box blank.

Jan,

Thank you very much for your quick and honest response.

I think I got the answer anyway from two people who responded to the same question I posted on the online Google Group misc.taxes.moderated.

Alan wrote:

“When the mutual fund you invested in buys and sells foreign stocks at a gain or loss, it is US source income. When a foreign stock pays a dividend, that is foreign source income.”

John wrote:

“The fund is in the US, it owns the shares in the US, so it’s US gain when they sell it.”

In conclusion, U.S.-based mutual funds don’t generate foreign capital gains, only U.S. gains.

Initially, I got confused by the instructions for Form 1116 which mention foreign qualified dividends and foreign capital gains in the same breath. Now, I assume foreign capital gains come from a foreign mutual fund for example, but I know not from a U.S. fund.

Hi Terry,

That’s a really good question. Unfortunately, I have no idea what the answer is. I hadn’t even thought about that until you mentioned it. But I’m afraid I don’t know the answer. Sorry. (So much for an enlightening response.)

I apologize in advance for posting here about Form 1116 (Foreign Tax Credit), which is a topic only indirectly related to the FBAR, but I couldn’t find a post on your site dealing specifically with this form.

For Form 1116, I know I may be required to make certain adjustments to my foreign source qualified dividends and foreign source capital gains (including any foreign source capital gain distributions) or losses, if I have any.

Since I own shares of a Vanguard international fund, Vanguard sent me a tax document clearly stating the amount of my foreign qualified dividends, but there is no mention of foreign capital gains.

Out of curiosity, I look at the websites of other U.S.-based mutual fund companies and never found any mention of foreign capital gains (and associated foreign taxes), whereas the topic of foreign qualified dividends (and associated foreign taxes) comes up regularly for funds investing in foreign securities.

Hence my question: why do U.S.-based mutual funds investing in foreign securities never report foreign capital gains to their shareholders (whereas they typically report foreign qualified dividends)?

Thank you in advance for your enlightening response.

Hi Oliver,

Number one–you are not a criminal. It’s pretty scary reading all that stuff and it makes it sound like you’re a criminal but, you know you’re not a criminal.

I actually called the IRS about having the Offshore Voluntary Disclosure office being with the criminal division. They told me they recognize that most of the people involved are really not criminals. It was more a case of they needed to assign the task to one office and the criminal division had the staffing. So, don’t feel like a criminal.

Now, there’s something new for you. It’s the Streamlined Filing Compliance for persons living inside the United States.

The big requirement is “non-willful conduct”. Meaning–you didn’t mean to break any law–you just didn’t know any better. Clearly–that’s you! I could be wrong, but my best guess is that you’re just a normal, nice guy trying to do what’s right. Had you know you were supposed to report those bank accounts, you would have, right?

Here the the IRS links about the streamlined filing:

http://www.irs.gov/Individuals/International-Taxpayers/Streamlined-Filing-Compliance-Procedures

http://www.irs.gov/Individuals/International-Taxpayers/U-S-Taxpayers-Residing-in-the-United-States

I think this is the program you’re going to want to check out.

And congratulations on that grandchild!

sorry for mess in previous comment. formatting didn’t survive.

Jan,

just found out your blog/web site related to “offshore/non-US accounts reporting” (FBAR). read your article on OVDI dated August 16, 2011.

reading further “here and there” on the web really made me feel like a Criminal; it also made me feel like there are not many ways [if any] to get “compliant” without being badly bruised [aka big penalties].

a bit of background followed by a few questions to you if I may:

I am a French born citizen living in the US for the past 25 years, and a naturalized US citizen since 2001.

since becoming a US citizen, I never bothered with the French stuff until only recently. I did not keep a french passport up to date nor “registered” as an expat at the French embassy. those steps were not mandatory and when I traveled, I did it on my US passport.

becoming a grandpa just a year ago made me change that as I intend to spend more time with kids and grand kid(s). my kids/grand kid being French citizens only [no dual citizenship] and living in France, I thought getting my French “paperwork” up to date could only simplify my future “extended” travels there. so I did “register as a French expat” at the embassy and got an up to date French passport. in short, I was not only ready to travel as a french guy but also am now on there “mailling list” and started receiving news letters and the like. that’s where/when I learned about FATCA , FBAR and such.

in 2007, I opened a bank account in France. later on this was converted into 2 bank accounts. never much money on them but still enough to see now that I was required to file FBAR. my sister was managing these accounts for me so I never worried about it and only used them as “atm” when traveling there or to send money from the US to help out the family.

the upcoming FATCA thing has changed everything and I started to look into these and realized that indeed not only was I supposed to report such accounts but that I also was “earning” money on one of the accounts.

again, nothing much BUT that means I find myself once again potentially labeled as a “Criminal” because I did not report such account and income (in the $300 range per year).the “French system” being what it is, bank records were not kept [no real needs over there unless one needs/wants to fight back the system and it’s a big “good luck to you” if one want to go that way] so I only have partial records on such accounts for the time being. am currently requesting back statement from said bank.

I understand that no one is supposed to ignore [not be aware of] the law but, and that might qualify me as stupid, I didn’t know until very recently.

so, my question to you would be “what/how to do to become -compliant-?

should I file 2013 FBAR by June 30 along with accurate 2013 income tax with schedule B [I had filed for an extension {with plenty of money to cover any tax due and even get a refund} in April so 2013 hasn’t been filled yet] and seek to “correct” previous years FBAR/income tax once I get my back bank statements

or

should I wait until I get all my paperwork and then file?

my first instinct would be to file 2013 on time so I can say “I am in compliance for the year 2013” and avoid penalties for FY 2013 though I might need to amend said filing later on once all years are corrected. would that even up the chances/risk of an audit?

“waiting to be ready” [assuming I am not called by IRS in the meantime] to file each and every concerned year would leave me exposed to penalties for each and every single year I am/was in default, including 2013.

now and in regard to that ugly word Criminal, every dollar/euros which got in or out of these accounts is easily traceable and “clean”. they came from wire transfer from a US bank [i.e. well documented banking operation]

the “maximum value” of said accounts is another question. by that I mean some money ends up being accounted for twice if I understand correctly.

for example, I have a “combined” statement referring to all activities in Euros [on both accounts] between December 31 2012 and February 1st 2013; lets call them account A and account B for the sake of this argument.

date of operation: account A: account B: (acct A+B)

balance as of 12/31/12 5894.49 15922.86 21817.35

withdraw on 01/14/13 4800.00

deposit on 01/14/13 4800.00

balance as of 02/01/13 1094.49 20722.86 21817.35

again, lets assume this specific statement represent the whole year 2013;

on 01/01/13 I had 5894.49 Euros on acct A but only 1094.49 Euros as of 01/14/13

and

on 01/01/13 I had 15922.86 Euros on acct B but ended up with 20722.86 Euros on that acct as of 01/14/13 (4800 Euros of which came from a transfer from account A)

accounting for “the maximum value” of all accounts, based of FBAR filing calculations, I “officially” had 26617.35 Euros ($36,663.00) in combined “maximum value” for the year 2013 though I never really had more than 21817.35 Euros ($3,0051.00) in real life.

based on that principle [of calculation], I may even have had more that 50,000.00 DOLLARS at some point in time (1 earlier year). probably not much more than 10 or 20 dollars above that 50K threshold but even a single dollar would bring you “above” that 50k threshold [i.e. possible need to have filed form 8938. here we go, one more “criminal act”]

so, basically, what to do and where to start from in order to become “compliant” but minimize the punishment would be my main questions to you.

streamlined procedures? quiet disclosure? OVDP? so many unanswered questions.

thanks for considering my request.

olivier