If you’ve been earning money driving an Uber in 2021, here’s some things that might help you when filing your taxes.

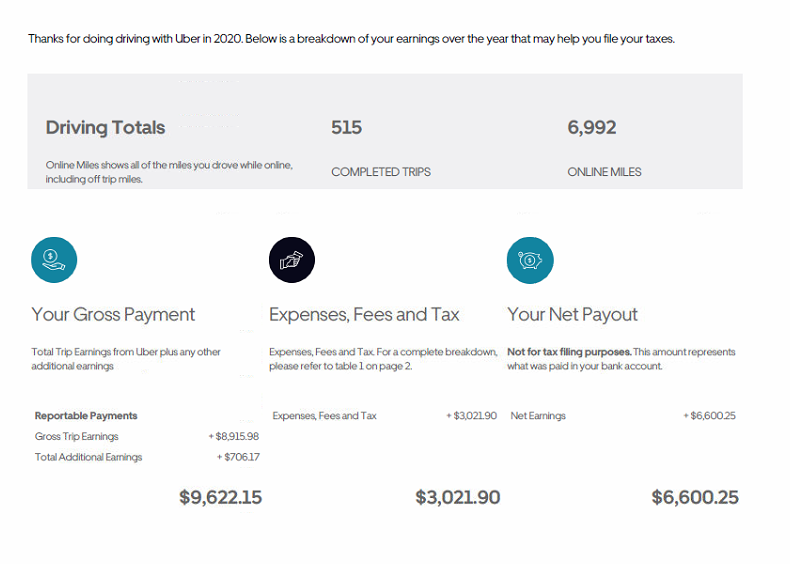

Whether you’re doing them yourself, of paying someone to prepare your tax return for you, the most important thing you need is your Uber statement. Here’s an example of one from the 2020 tax year.

As you can see, it shows the gross payment, the expenses, and the net payout. Also, what’s really important is that it shows the miles that you drove. You really need that mileage number for your taxes.

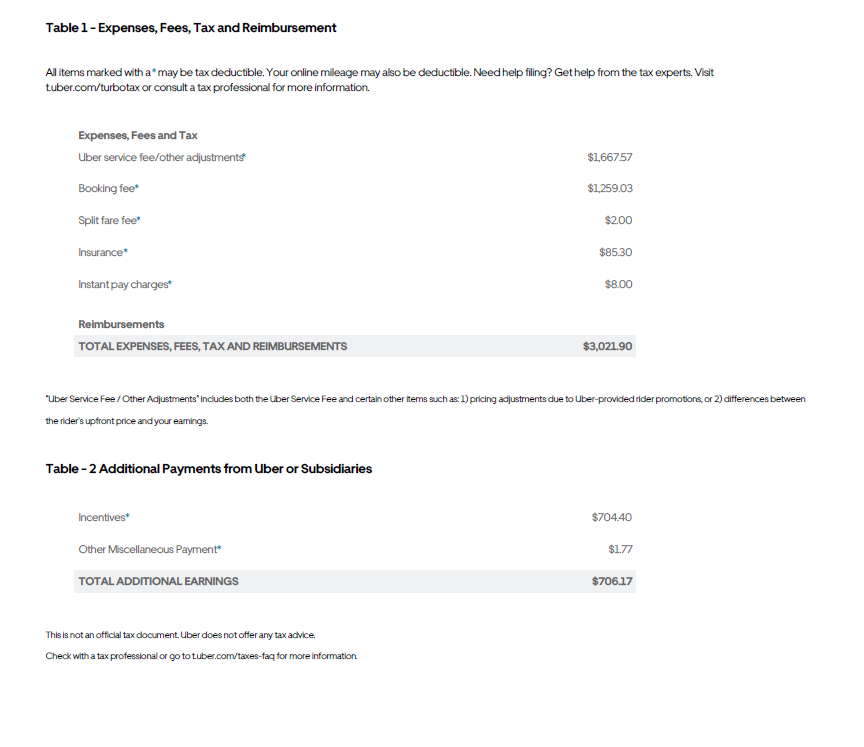

There’s a second page to that statement and it looks like this:

This is really helpful because it breaks down what those expenses were. It also breaks down any additional compensation that you received. You’ll see in this example that the taxpayer received $704.40 in incentives and $1.77 in other miscellaneous payment.

You would think that Uber would send out a 1099NEC for the $9,622.15 – the gross payment that they reported on page one – but they’re a little different. They only give you a 1099NEC for your Additional Earnings. In this case, the taxpayer got a 1099 for the $706. She still has to report the full $9,622 of earnings though.

So how do you do that?

For the vast majority of people, you’re going to be doing this on a form called Schedule C. And it’s just another form that’s a part of your regular 1040 tax return. You don’t file a separate return for your Uber income, it’s all combined with your main taxes.

Here’s a link to get the form: https://www.irs.gov/pub/irs-pdf/f1040sc.pdf

Ideally, you should be using tax software to prepare your taxes. I’m showing you the forms and where things go so that you know what it’s supposed to look like when you’re done.

You see that Box B? Enter code from instructions? If you’re an Uber driver (or Lyft, or Door Dash, anything like that) your code is 485300 for taxi, limousine and ride sharing services.

One line F it asks your Accounting method: you’re going to pick cash.

Line G – did you “materially participate” in the operation of this business in 2021? Well Yes – if you drove, you participated.

Line H – you just check that box if it’s the first year you’ve done it.

Line I – Did you make payments that require you to issue a 1099? Probably not. Uber drivers are solo workers. So you’re probably not issuing any 1099s. If you’re an Uber driver who’s hiring other people to work for you, you should probably check with a tax professional.

Now we’re into the Income portion of your return. Gross receipts. That’s easy – It’s right on the Uber statement. Using the example from above, you’d put $9,622 on line 1.

A note about 1099s and computer software: If you get a separate 1099 from Uber like the taxpayer in the example, you’re going to need to enter that 1099NEC as a separate document. In that case, you’d enter the Gross Trip Earnings of $8916 on the Schedule C in your tax software and the software should also send the 1099 income to the Schedule C, so you still wind up with $9,622 on line 1. The nice thing is, the Uber statement breaks it out for you.

Now in the expense portion of the Schedule C – probably the most important part is your car and truck expenses which is line 9, but I’m going to skip over that for a minute and get the easy part first, which is your other expenses. They would go on line 27a. I like to list them out separately, but that’s just me. I also round to the nearest dollar, the IRS doesn’t want to look at pennies and most tax software won’t even acknowledge cents.

A note about Cost of Goods Sold: As an Uber driver, you’re selling a service, not a product. You’ll leave the whole of Part III Cost of Goods Sold section blank.

So now you’ve got your main expenses in. It’s time to add in your mileage. Mileage goes on page 2 of your Schedule C in Part IV. Let’s go over those questions one at a time.

Line 43: When did you place your vehicle in service for business purposes? It means, when did you start driving for Uber that’s all that means.

Line 44: Of the total number of miles your drove your vehicle during 2021, enter the number of miles you used your vehicle for:

a. Business

b. Commuting

c. Other

You have the easy answer to a Business miles – because Uber gives it to you right on the statement. In this example, it was 6,992 miles.

Line B – you leave blank because really for Uber you’re not commuting.

Line C other – this seems to be the hardest one for most people. How many non-business miles did you put on the car this year? People often ignore this, but it’s important. And if you ever get audited, the IRS will want to know. In this example, the person only put 8,632 miles on their car for the entire year. So we’d put 1640 down for other. (8,632 miles for the year minus the 6,992 miles driven for Uber.)

And then you’ve got the Four Questions.

45. Was your vehicle available for personal use during off-duty hours? Yes or No.

46. Do you (or your spouse) have another vehicle available for personal use? Yes or No

47a. Do you have evidence to support your deduction? Yes – because Uber gave you evidence.

47b. If yes, is the evidence written? Yes – because it’s written right in that Uber document.

Now if you’re using tax software, it will compute the auto expense for you and automatically put it on line 9. But if you’re doing this by hand, you’d take the 2021 mileage rate, which is 56 cents per mile, and multiply it by the 6,992 business miles and you get $3,915.52 – which you’re going to round up to 3916.

So, in this example, after you’ve taken out your expenses you’ve only got $2,684 of taxable income.

(Gross income of $9,622 minus auto expenses of $3,916 minus other expenses of $3,022 equals net profit of $2,684.)

That number will flow onto line 3 of the Schedule 1 which flows onto line 8 of your regular 1040. (Don’t be intimidated by these line numbers and schedules. Use a tax software and it should all be automatic.)

The part that gets a little hinky is the Self-Employment tax. Once again, the software should compute it for you. I’m just telling you so that you know to look for it. Self-employment tax is computed on Schedule SE. If you’re doing this by hand, your net profit goes on line 2, then literally you’re following the instructions line by line until you get to the bottom of the page.

The quick and dirty check to make sure the math is right is you take your net income and multiply it by .9235, then multiply that by .153. That’s going to be your self-employment tax. That goes on line 12 of Schedule SE and on line 4 of your Schedule 2 and that flow onto line 23 of your 1040. In this case, the self-employment tax is $379. (2684 times .9235 times .153 = $379.)

And there’s one more thing. I promise, this isn’t too bad. You get a deduction for ½ of the self-employment tax that you have to pay. We don’t want to miss any deductions right? So if the self-employment tax is $379, half of that is $190 (because we rounded up). It’s going to go on line 15 of Schedule 1 which will flow to line 10 of your 1040.

I’m talking about a lot of forms and Schedules here and that sounds intimidating, but don’t let it scare you. Your tax software should generate everything. I’m mentioning the forms so that you know what to look for. If you’re using to doing just a straight 1040 with no extra schedules, it might seem weird to have all these other pages print out. But a lot of the forms only have one or two items on them.

If you’re filing a return with Uber income on it, in addition to your 1040 tax form you should also have:

Schedule 1-Additional income and adjustments to income

Schedule 2-Additional taxes

Schedule C – Profit or loss from business (This is the heart and sole of your business taxes.)

Schedule SE – Self-employment tax

Here’s a link so that you can see how they’d look using the numbers in the example. https://robergtaxsolutions.com/wp-content/uploads/2021/12/2021-Fake-Uber-Driver-1.pdf

I always recommend talking to a professional to do your taxes. But I also recognize that not everyone can afford it. Hopefully, this can help you with your Uber Tax Return.

FAQs

I won’t have time to answer your individual questions on this, but I do have some questions that people ask me all the time so I thought I’d address them here.

Q: I drove more than the mileage it says on my Uber statement. Can I claim that mileage as well?

A: Yes. You’ll just need to document it with some type of a mileage log. I like the MileIQ app, but you can use whatever works best for you. (I don’t get paid by Mile IQ, I just like their app.)

Q: I paid a lot of money for my gas and car repairs. I want to claim those expenses. Can I add those to my mileage?

A: The mileage expense includes your gas and repairs. It’s an either/or type of deduction. If you prefer to claim your actual expenses, that’s fine. Just make sure you document them with receipts. Remember, the amount of your actual expenses you can claim is limited by the percentage you used the car for business. It’s also important to remember that if you claim your actual expenses the first year that you use a vehicle – then you can NEVER claim your mileage in a future year.

Q: I bought a new Lexus for $40,000 and I want to write it off as a business expense. Can I do that?

A: That’s outside the scope of this blog post. (There’s a whole lot of issues there.) Generally, I’m not in favor of it, but this is one of those times where if you want to write of the purchase of a new vehicle, it’s worth the money to get professional tax help.

Q: I have other expenses besides my miles and what’s on my Uber statement. Can I claim those?

A: Yes. Some extra expenses might be bottled water or snacks for your passengers or your cell phone usage. Normal car maintenance would be included in your mileage, but one driver I know had to pay to have her car cleaned after a drunk passenger threw up all over her back seat. I wouldn’t consider that to be a “normal” auto expense so I included that as an additional business expense on her return.

Q: I didn’t just drive for Uber, I also drove for Lyft and Door Dash. Do I need a separate Schedule C for each job?

A: No. You can combine your Uber, Lyft and other driving jobs onto one Schedule C because they’re all in the same category. Now, if you drove for Uber and moonlighted as a DJ or some other completely unrelated job, then you’d want to prepare a separate Schedule C for that business.