I volunteer with an organization called The Arya Foundation We help provide adaptive equipment for children with special needs. Because of that, I had the opportunity to speak with a group of parents about tax issues for families of children with special needs. I’ve written about tax issues and special needs before but with the new tax laws, and given some of the questions I was asked, I decided it was time to write about it again.

ABLE Accounts

First – let’s talk about ABLE accounts. ABLE stands for the Achieving a Better Life Experience Act which was passed in 2014. ABLE accounts are not tax deductible on your federal tax return. But,iIn some states, like here in Missouri, they are deductible on your state tax return. Contributions to the ABLE account can be made by anyone, mother, father, grandparent, even the beneficiary! But the contributions are limited to $15,000. ($14,000 in 2017.) Now here in Missouri, you can only take a MO tax deduction for up to $8,000 or $16,000 for a married couple.

Wait! You say. You can only contribute $15,000 – how do you take a $16,000 tax deduction? Good question! Technically, each parent may contribute up to $15,000, so if you contribute over $8,000 you want to split the donation between the spouses.

What about grandma? Does she get a deduction for contributing to the ABLE account? In Missouri, only the account holder may claim the deduction, so that would be the person with the ABLE account, or the parent or legal guardian of the child. That means, unless grandma is the guardian, she won’t be able to claim a deduction on her contributions to the account.

There’s a whole lot of good that goes with Missouri ABLE accounts, but there is one big disadvantage: if your child dies, money in the ABLE account may be used to pay back the Missouri HealthNet program. So if you have received HealthNet program benefits – you could forfeit the ABLE account funds in the event of your child’s death. It’s a good idea to talk to a financial advisor about all of your investment options for your special needs child. An ABLE is a wonderful tool, but it’s not the only option available in your tool box.

Child and Dependent Care Credit

Congress left the Child and Dependent Care Credit in tact. Basically, you can receive a tax credit for money you paid for child care expenses for a non-disabled child up to age 13, or for any age disabled child or spouse. The credit worth up to $1,050 for one child or up to $2,100 for two children. (This is based on child care expenses of up to $3,000 per child.)

A similar benefit is a child care FSA which allows you to exempt up to $5,000 from your taxable income for child care. You can’t claim a child tax credit on money that was placed in your FSA, but if you have two children and spent over $5,000 then you claim the Child Care credit on the excess over the $5,000 (up to the $6,000 mark.)

Using 529 Plan Funds for K-12 Education

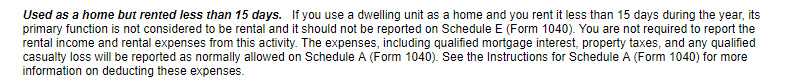

This is great news for special needs families. If you need to send you child to a special school, or need to hire a special tutor – now you can use 529 plan funds to cover those expenses – up to $10,000 a year. And in Missouri, you can pretty much churn your deposit and turn around and spend it without penalty, taking advantage of that Missouri tax deduction (Up to $8,000 per spouse.)

What About Transferring 529 Plan Money to the ABLE Account?

Yes! Now you can transfer money from a 529 account to the ABLE account. Now the contribution limit of $15,000 still applies, so you could not transfer more than $15,000 in any given year. But, if you are concerned about Missouri taking the ABLE money in the event of your child’s death, you could fund the 529 account, taking advantage of the tax deduction, and move the money to the ABLE as necessary.

Savers Tax Credit for ABLE Account Holders

This is new, and pretty cool. Let’s say your special needs child is working and funding his or her own ABLE account. (As opposed to an ABLE account funded by parents.) Your child could qualify for the Retirement Savers Credit. (Subject to Retirement Savers Credit rules.)

Increased Child Tax Credit

While we are losing the exemptions that we used to claim for children, the child tax credit is going up to $2,000 from $1,000. And the phase out is increasing to $400,000 for married couples and $200,000 for single parents which will allow more families to claim the credit. The child tax credit is limited to families with children that are under age 17.

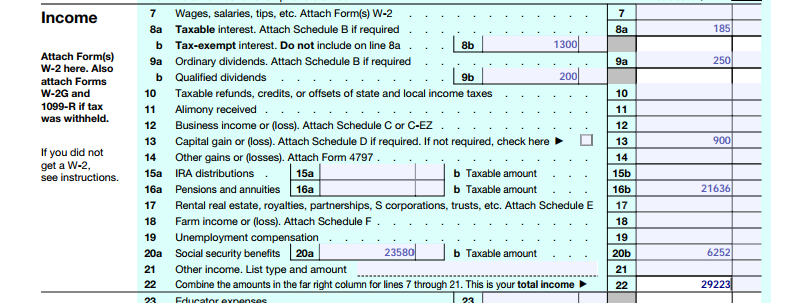

New Threshold for Medical Expense Deduction set at 7.5%

This is one of the few tax provisions that is retroactive to 2017. Originally, the threshold was set at 10% of adjusted gross income, but it was moved down to 7.5%. What that means is that a family making $50,000 used to have to spend over $5,000 on medical expenses in order to qualify for a deduction. With the new threshold, that same family would be able to claim a deduction on any expenses over $3,750. Of course, with the new, higher standard deduction it will be more difficult to be able to claim medical expenses.

For a full list of expenses that you may be able to deduct, check out IRS Publication 502.