Are You A Hobby or a Business?

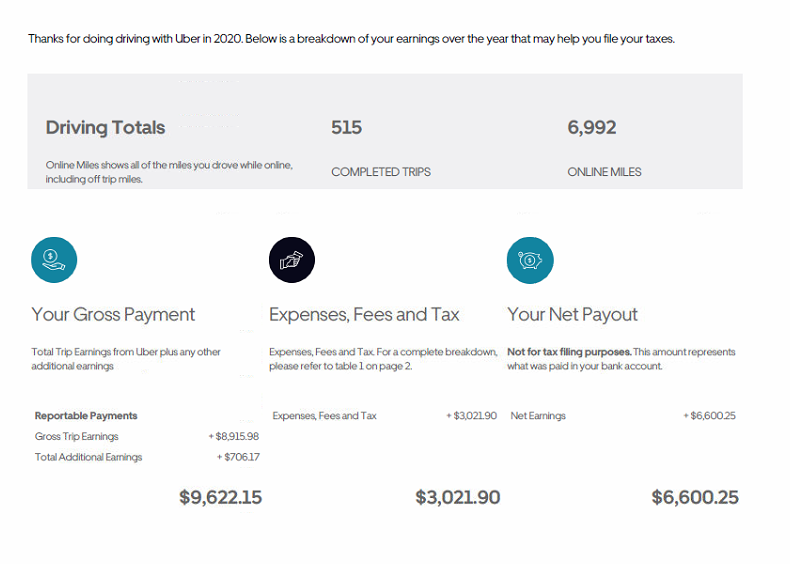

Many performers don’t think they have a real business – they’re just doing a few shows on the side, it really is more of a hobby than a business. And if you’re just getting paid in cash by private citizens that’s fine, you can get away taxwise with being a hobby. But, if you’re working through a company and you earn over $600 in a year, then you’re required by law to receive a form called a 1099NEC. And if you receive a 1099NEC, the IRS pretty much treats you like a business.

So the question becomes, at what point does your performing become a business instead of a hobby? A lot of your decision may be based on taxes.

Hobby Income Taxes

Hobby income is taxed at your regular income tax rate. It goes on line 8 on the Schedule 1 of the 1040 tax return. Now in the past, you might have been able to deduct some of your hobby expenses but that option is no longer available. So, if your federal income tax rate is 22%, and you earned $5,000 on your performing, then your tax on that $5,000 will be $1,100.

Business Income Taxes

Business income is taxed at your regular tax rate plus the self-employment rate. The self-employment rate is 15.3%. So, if you’re in the 22% tax bracket, the tax rate on your performing income would be 37.3%. That means that the $5,000 you made income would now be taxed $1,865. Which sounds awful at first blush.

But the advantage to being taxed as a business is that you get to write off your business expenses directly against your income. Let’s say you had $3,000.00 in business expenses, then your tax would only be $746.

($5,000 income – $3,000 expenses = $2,000 net income to tax)

($2,000 taxable income x 37.3 percent tax rate = $746 in taxes)

If you have business expenses, being able to claim your performance income as a business can be a good thing. This is especially true if you have a business loss. You can use your self -employed business loss to offset other income – like wages you receive from another job – on your tax return. Be sure to read about QBI further on though because there’s more to business taxes than just this.)

1099NEC If you receive a 1099 NEC, the IRS will automatically count you as being self-employed – even if you have another job somewhere else.

What will be different about your tax return if you’re a professional performer instead of a hobby performer?

You won’t need to incorporate or file a special business return. Most people will just include their performance income on a Schedule C form which becomes part of your 1040 tax return. It will show your business income and expenses.

Form Schedule SE will show your self-employment tax owed.

Common Tax Deductions for most Small Businesses

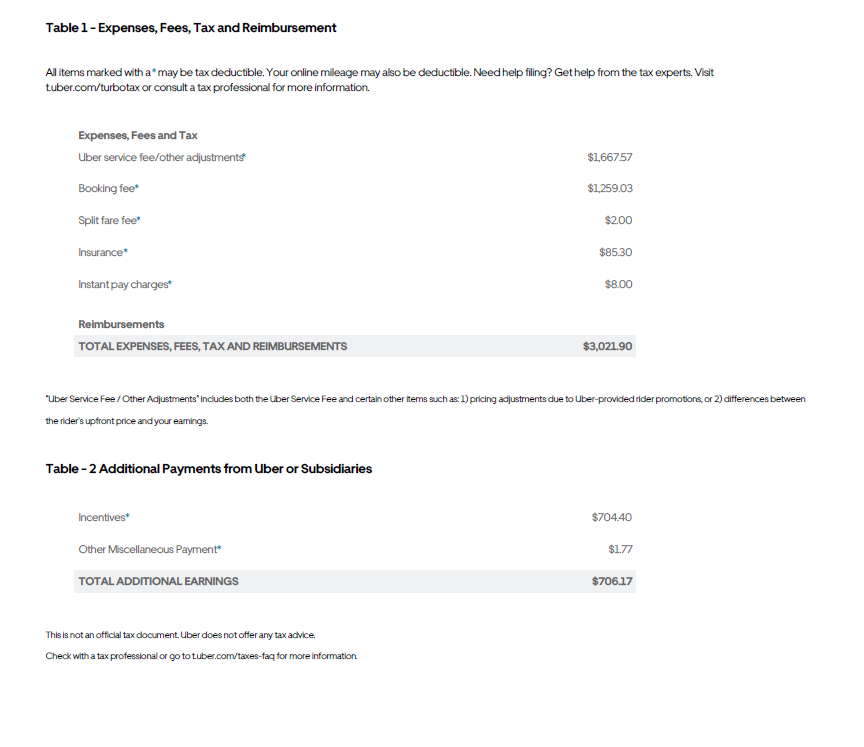

Most small businesses have these deductions on their tax returns:

- Advertising

- Home Office expense

- Mileage

- Supplies, etc.

The important thing to know is that as far as the IRS is concerned, you may deduct an expense that is ordinary and necessary to your business.

A few exceptions to the ordinary and necessary: you might need nice clothes for an audition or an interview show – but clothing that you can wear in a normal situation cannot be deducted. It’s one of the most common questions I get which is why I put it up here. Costumes, on the other hand, are deductible.

Your two best Tax Deductions

The two best tax deductions for a small business owner are the Mileage and Home Office (Studio) deductions. These deductions are great because they are expenses that you already are paying for anyway.

Mileage

If you want to claim mileage, you must keep a mileage log. For every business audit I have ever worked on – the IRS requested the mileage log. The IRS wants to know how many total miles you put on the car, not just your business miles. This is the most forgotten about issue but it’s really helpful to know. You can get a free mileage log on our download page

Super Silly Tax Tip: When you’re watching the Rose Parade (or football game or something that you know you do every year) write down the mileage on your odometer on January 1st and stick that number with your tax records. This way you’ll be able to figure your total mileage for the year – just subtract last year’s odometer.

Home Office

You don’t need a desk and a computer for your home office. It could be a storage space for your supplies, the place where you do your work, or the room you keep your product or supplies in. It doesn’t have to be a separate room in your house, it can be a section of a larger room. It can also be very small.

The most important reason for claiming a home office is so that you can claim your mileage to your gigs. The important issue is “regular and exclusive”. Maybe you work in your kitchen – that’s fine but you can’t claim your kitchen as a home office because you cook dinner there. You have to use a space exclusively for your business in order to deduct it. So, if you work in your kitchen, you need another space to maybe store your supplies that you can claim as your “exclusive” working space.

Should you become an LLC?

Generally, performers tend to be “individuals”. An LLC is not required. An LLC is a limited liability company. The idea is that your liability – meaning if someone wants to sue you – is limited. If you decide to become a Limited Liability Company anyway there are rules you must follow.

- Get a Federal EIN number.

- Set up a bank account for the LLC.

- Run all of your business income and expenses through that bank account.

If you don’t do all those steps, you’ve “pierced the veil” of the LLC and you’re just wasting your time and money.

“Piercing the veil” means that someone could still sue you personally even though you have an LLC. If you’re not going to bother with the separate bank account and getting a separate EIN number, you’re not protected by your LLC.

In most cases, a decent business insurance policy might be all you need. But if you decide you want to set up an LLC, it only costs $50 in the state of Missouri. It only takes about 10 minutes to do it online.

If you choose to become an LLC unless you make a special election to be taxed differently, you would still claim your business income on a Schedule C like an individual.

DBA Doing Business As

You might have a business name that you want people to use, like “Willie’s Writings”. You can file paperwork for “doing business as” with the Secretary of State’s office. It only costs $7.00. That way you can receive checks under your business name instead of your own name.

A word about making Estimated Tax Payments

If your business is successful, you’re going to be making money. And if you make money – you have to pay taxes. If you’re going to have a tax balance due of more than $1000.00 federal, you should start making estimated tax payments. A good rule of thumb – if you make over $6,000.00 after deducting your expenses then you should make estimated payments.

It’s easy. You can go online at IRS.gov and click on “Pay”.

The Qualified Business Income Deduction

QBI – What you need to know about your business income for 2021

As a small business owner, there is something called the Qualified Business Income Deduction. QBI for short. QBI is a 20% deduction off your business income from your taxable income. It’s really pretty awesome.

Simply speaking – remember that example above where you have $5,000 of income, but after expenses you only had $2,000 of taxable income? Well, with the QBI deduction, you still pay your self-employment tax on the full $2,000 – so that’s 15.3% = $306.

But then, you get to deduct 20% from the $2,000 before you pay the regular tax. In this example you’d take 2000 – 400 = 1600, then take 1600 times 22% and you get $352. So, really, instead of paying $746 like in the earlier example, you’ll only pay $658 – a savings of $88.

That doesn’t seem like much, but if you had a net income of $50,000, at the 22% tax bracket you’d be saving $2,200! The QBI can be a really important tool for you.

But not everyone can qualify for the QBI deduction. For an automatic QBI deduction – meaning – you don’t have to jump through any hoops to qualify, a single person would have to have income below $164,900. A married person would need to be below $329,800.

You might be thinking – I’m just starting out as a performer, I’m not Johnny Depp. I don’t make anywhere near those numbers. But I’m talking about your total income. So, if you’ve got a day job, or a spouse with a high income, your QBI deduction could be lost. (For what it’s worth, Johnny Depp doesn’t make anywhere near $329,800 – he makes a lot more!)

But there are strategies for QBI if your income exceeds those limitations. That’s where it makes sense to talk with your accountant about what’s best for your situation. That’s really outside the scope of this little blog post.