You can prepare your own 1099 MISC forms. All you need are the right forms.

The 1099-MISC form is what you need to give to a contract laborer if you pay them over $600 in the course of the year. There’s a whole new emphasis on reporting and so many more businesses are finding that they need to be issuing 1099s. But there’s a lot of confusion about how.

A few years ago I was at the IRS office near my house asking if they had any of the new 1099-MISC forms that I could have. “What do you want them for?” The IRS agent asked me. So I explained to her that I was teaching a class about 1099s and wanted to have the actual forms to hand out to the class.

“Oh thank God!” She said. Now, I work with the IRS a lot. I do audits and debt resolution, and although I genuinely like most of the agents I get to work with, I can assure you that “Oh, thank God,” is not a phrase used when the IRS is dealing with me. (Unless it’s used as “Oh thank God she’s gone now, but that’s about it.)

So I asked her why she was so excited that I was teaching a 1099 class and she told me about all the mistakes that they see and the problems they have with bad 1099s. “Somebody’s got to teach this stuff,” she told me. So I figured it would make for a good blog topic.

The Basics

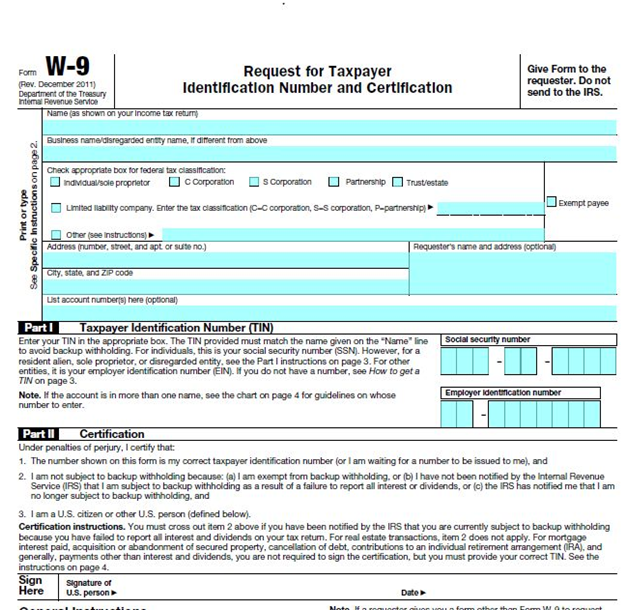

Here’s a link to see the 1099-MISC form. 1099MISC If you’re the business owner, you need to issue the 1099 to the recipient by January 31. New for 2017 – you must submit the 1099 to the IRS by January 31 also.

My directions here are just an overview; here are the official IRS directions: IRS 1099 Directions If you have questions, that’s the best place to look.

The Quick and Dirty

Generally, when you prepare a 1099-MISC you’ll put the dollar amounts in box 7 for non-employee compensation. If you’re preparing a 1099-MISC for any other reason, you should check the rules to make sure you’re using the right box. I’m talking about non-employee compensation. Write in the white part of the box, not the red.

Payers name, address, etc, is you. Recipient is who you paid. I recommend using EIN numbers instead of Social Security Numbers whenever that’s an option for safety.

You put the whole amount of money you paid the person into box 7. For example, let’s say I hired Brad the Painter to do some work in my offices. I paid him $600 for the labor, $75 for the paint, and $25 for his parking. If I paid that money to Brad, even though part of it was for supplies not labor, I give him a 1099 for the whole $700. Brad will write off the $75 for paint and $25 for parking as his business expenses.

Mail your 1099MISC with a transmittal form. 1096 Transmittal Form

The filer is you (or your company.) The forms being reported is the 1099-MISC. The total amount reported on the 1096 is the total of what you paid the 1099 contract laborers. Here’s a clue—that number you put in box 5 should also go somewhere on your business tax return as a 1099 contract labor expense.

The IRS’s Biggest Complaints

- People are supposed to use the red forms. You have to use the real form; you can’t print it off the computer, even if you have a color printer. Those forms are scanned so it has to be the right paper. You can order your 1099-MISC and your 1096 transmittal from for free from the IRS. Here’s the link: IRS Forms Order

- Don’t cut the copies. Leave all the pages whole. If you only have 1 form to issue, just leave the second one blank.

- Don’t staple the returns. Don’t fold, spindle or mutilate them in any way. They have to go through a scanner so leave them plain.

- That means you have to mail them in the big envelope. I keep getting asked about that. Don’t fold means use a big envelope.

Smaller Complaints

- Do not use a $ sign when typing in the amounts. It’s already on the form.

- Do use a decimal point and cents. So I didn’t pay Brad $700 I paid Brad 700.00

- Do not put 0’s in spaces, just leave them blank.

- Do not use # signs. For example, on the form 1096 where it asks for the number of forms, I would write 1, not #1.

A note about handwritten returns: Handwritten returns are more likely to have errors than other returns. Usually it’s a Taxpayer Identification Number and name mismatch. If you are using a person’s name—use their social security number. If you are using a business name, use the EIN number. That’s a common mistake. Be sure to use block print and not script. Yes, I need to say, print neatly.

If you are typing it on a typewriter, you need to use black ink and 12 point courier font.

The 1099-MISC reporting rules have a lot of people confused, but you don’t have to do this alone. We can prepare 1099-MISC for a fee and we e-file them with the IRS.