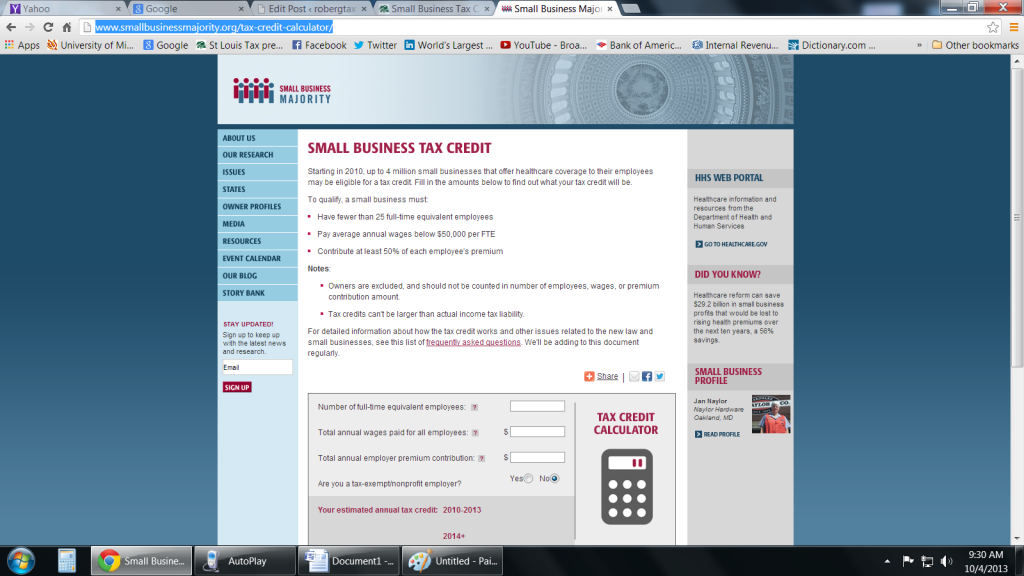

http://www.smallbusinessmajority.org/tax-credit-calculator/

“Starting in 2010, up to 4 million small businesses that offer healthcare coverage to their employees may be eligible for a tax credit. Fill in the amounts below to find out what your tax credit will be.

To qualify, a small business must:

Have fewer than 25 full-time equivalent employees

Pay average annual wages below $50,000 per FTE

Contribute at least 50% of each employee’s premium

Notes:

Owners are excluded, and should not be counted in number of employees, wages, or premium contribution amount.

Tax credits can’t be larger than actual income tax liability.

For detailed information about how the tax credit works and other issues related to the new law and small businesses, see this list of frequently asked questions. We’ll be adding to this document regularly.”

Hey Vic,

Why are you posting about Foreign tax credits on the healthcare page?

Attach the spreadsheet to your return. Show the schedule of what is carried forward and back.

Now, if you’ve got excess carryover from 2014 and you could use it on 2013, then yes, you can carry it back.

Hi Vic,

You may carry back a foreign tax credit one year, but you are not required to.

Jan, may be you can clarify this:

Can a taxpayer opt to carry forward Foreign Tax Credit (on form 1116) without carrying it back (to previous years)? Thanks

Jan, can you please shed light on the above? Thanks.

Jan, please note that the 2011 figure for FTCL should read 334 (not 33).

Jan, I hope you can shed light on a question I have on Foreign Tax Credit w.r.t form 1116. Foreign Tax Paid, Foreign Tax Credit Limit, and their differences are given below. I hope the numbers show up properly aligned in columns. I am planning to amend personal returns for 2012, 2013 and 2014. The question is this:

How much carryover can I claim for 2013? Can I claim the 2011 unused $168 plus the 2012 unused $250? And to make up the difference, after carryover from earlier year(s), can I carryback part of $1353 from 2014? I have never used carryover or carryback before.

Unfortunately my software doesn’t help me compute the worksheet for submission to IRS. Any pointers on how to create one for IRS (as they require detailed computation attached). Would a simple spreadsheet suffice? Can I use the same sheet for all 3 years? Thanks for your help.

FTP FTCL + or –

2009 0 360 -360

2010 399 552 -153

2011 502 33 168

2012 1055 805 250

2013 57 808 -751

2014 2855 1502 1353

Yes Brian,

that does include partners and S Corp shareholders who are active in the business. Thanks for pointing that out.

When you write that “owners are excluded” does that also mean partners or S corp shareholders who are active in the business?

Maybe the best suggestion is to contact a tax professional for this tax credit calculation.