With all the questions the IRS requires tax preparers to ask, getting your taxes done can seem more like an interrogation than tax prep.

I took a phone call from a fellow awhile back who was absolutely furious about some of the questions his tax preparer had asked him. The preparer had asked a whole bunch of questions about his kids and even asked to see their report card from school. He said, “My daughters are 4 and 2 years old. They don’t even go to school yet!”

So what’s going on here?

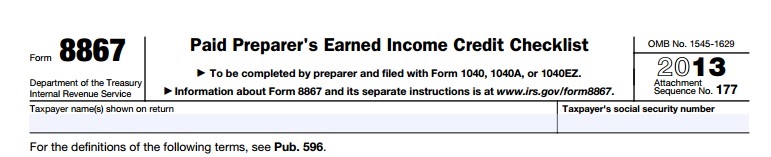

It’s all related to an IRS form—# 8867. Form 8867 has to be filled out and sent in with every tax return that has the Earned Income Tax Credit. Now, this form has been around for awhile, but it used to be that a tax preparer was just supposed to ask some questions and you’d keep that information to yourself. Now, the IRS expects you to send the form in with the tax return. If a tax preparer doesn’t complete the form and send it in with an EIC return—the IRS charges a $500 penalty to the tax preparer.

That’s $500 per return. You miss too many of those and you could be out of business. For most preparers, that’s more than what we charge to prepare an EIC return.

Now if you prepare your own tax return, you don’t have to worry about form 8867, it’s only for paid tax preparers. But if you have your taxes done at H&R Block, or Jackson Hewitt, or even me—that form must be completed, and signed, and sent with your tax return. (If your tax return is e-filed, we are required to keep the signed copy in our files.)

And the form seems to ask for more and more information every year. Now there’s a whole section about documents: documents to prove your kids live with you, documents to prove a disability, and documents to prove self-employment income. Tax preparers are now expected to look at a taxpayer’s documents to verify the information on an EIC tax return. School records, like report cards, are usually the easiest thing to use for documentation. Of course, report cards aren’t very helpful when your children aren’t in school yet. No documents, no form 8867. No form 8867, no tax return. No tax return, no refund.

It’s like the IRS is trying to turn regular tax preparers into the EIC police. It’s not a job we asked for, but it’s a regulation that we’re required to enforce. The penalties are so stiff that we’ll all be out of work if we don’t go along.

So remember, if you tax preparer asks to see your child’s report card, he doesn’t care if your son got a D in math or is a straight A student; he’s just trying to help you get your refund.

Hi Larry,

I edited your comment for privacy reasons. (And to avoid getting sued!)

Bottom line, yeah, something is fishy.

Now technically, if you don’t pay for the tax prep–then the preparer is not required to put her ID on there. It’s only for PAID preparers. So if money is changing hands–there’s an ethical issue. No – money, no ID required.

That said, I still sign returns for my family members and put my ID on them. But that’s me.

AARP preparers, and VITA preparers, they don’t get paid so they don’t sign the returns and they don’t get any money for their work.

I think the biggest issue here may be the worker classification as independent contractor instead of employee. If they’re really misclassifying employees, that’s a very real problem. But, if this is your wife’s family–do you really want to stir up that hornet’s nest?

I think that for you, filing as married filing separately is a smart move for as long as you believe there’s something wrong about your wife’s income. I would also have someone else do your taxes (since you obviously don’t trust this person) instead of handwriting her name into the tax return. Besides, you should be e-filing that return, not mailing it in. Actually, that’s a bigger red flag than anything else–professionals are required to efile if they do 10 or more returns.

Scenario: A professional tax preparer does tax return for Married Filing Jointly however husband refuses to sign it as the Tax Preparer has not printed name or signed it (plus he feels that there are major errors in wife’s part of the 1040 – being a Misclassified Employee, wrongly classified as an IC and making way less than Minimum Wage and Overtime so paying a fraction of taxes that should be). Tax Preparer then processes a new Married Filing Separately set of returns. Again, no Tax Preparer identification or signature on either form. Wife signs her’s. Husband signs his put PRINT the Tax Preparer’s name in (but does not sign for Tax Preparer).

Q: Isn’t the Tax Preparer (who is an EA and Currently at XXXXXXXXXXX. and in the past was a Senior Associate at XXXXXXXX and Tax Associate at XXXXXXX have signed these Returns. Then… to make it more difficult…

Q: The Tax Preparer tells the wife that she (Tax Preparer) doesn’t have to ID herself and sign if she’s doing the Returns for family members. And to make it more difficult, the Tax Preparer is the Financial Adviser for company that wife works for and also does that company’s books (and help set up this IC classification concept – though really workers – with this company). Aren’t there some illegalities as well as ethical problems there???

The IRS is trying to turn Enrolled Agents into the tax police while unlicensed preparers are getting away with filing fraudulent returns. I wouldn’t mind the extra paperwork so much if I saw any progress being made against the fraudulent preparers. They’re not just a danger to the profession, they hurt innocent children with their fraudulent EIC claims.

Over the last few years, Form 8867 has morphed from a 2-page document retained in tax preparer records into a 5-page monstrosity submitted with every tax return on which a tax preparer has completed an EIC claim.