I was sitting out on the deck with my husband and he asked me what I wanted for my birthday. I ran down my usual answers, “world peace, ending world hunger, etc.” He gave his usual answer, “Probably not this year.” I told him, “That’s alright, the Supreme Court just passed marriage equality, that makes my life easier. I’m happy with that.” He gave me that raised eyebrow look and said, “Care to explain that one?”

I’ve been married to this man for over 30 years so you might not think Obergefell v. Hodges will have much of an affect on me personally, but as a tax professional, it does. Here’s a little history of how legislation and the Supreme Court decisions have affected taxes over the past 11 years.

Massachusetts legalized same sex marriage back in 2004. That was the beginning of the crazy tax returns. You see, while you could be legally married in Massachusetts, the federal government didn’t recognize the marriage. So, you had to file as married on your state return and single on your federal. As a tax preparer, you had to prepare three tax returns instead of one. Back in those days I was an instructor for H&R Block. I remember teaching how to prepare that return in one of my classes. It was pretty crazy and very complicated. Living and working in Missouri, I didn’t see many Massachusetts returns, but we still have to know how to do them.

More states adopted gay marriage, but it was still illegal in Missouri. Couples were getting married in Iowa and living in Missouri, but they still couldn’t legally file jointly here in Missouri. Some of my business colleagues and I worked on a tax strategy to help couples who were “married for all intents and purposes but just not legally recognized in the state”. It was a good tax plan while it lasted, and for some couples it was actually better tax-wise than married filing jointly. But of course it didn’t solve the issues of Social Security, healthcare, or pension benefits.

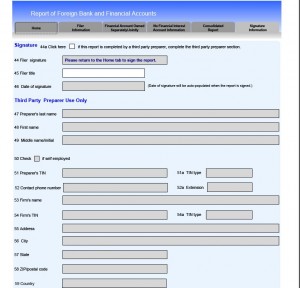

In 2012, the First Circuit Court of Appeals ruled that the Defense of Marriage Act (DOMA) was unconstitutional. This issue was headed to the Supreme Court, but hadn’t been settled yet. Which was another tax headache. You see, if the Supreme Court ruled that DOMA was unconstitutional, it would affect tax returns, but you can’t change your tax return based on the first circuit court of appeals. But–there’s a three year limit to amend a return for a refund. So, if you didn’t want to miss out on a potential refund for 2009, you had to file something called a “protective claim for refund.”

That meant, you were filing an amended return based upon something that hadn’t happened yet, hoping it would. The IRS would just stick those returns in a drawer until (or if) the issue ever came up. You had to write: “Protective claim for refund contingent upon the US Supreme Court decision on the First Circuit Court of Appeals case regarding the Defense of Marriage Act, Gill v. OPM.” If you didn’t work it just right, the IRS could just reject your claim.

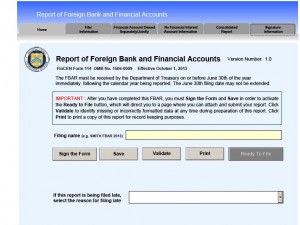

In June of 2013, the Supreme Court held in United States v. Windsor that the federal government was required to recognized same sex marriages.(I know, I know, what happened to Gill? Windsor was heard first so that became the landmark decision and the Gill petition was turned down in light of the Windsor ruling. Your Amended return claiming Gill would still be good because of Windsor though.) This meant that if a couple were legally married in Iowa, for example, that they would not only be allowed to file a state return as married filing jointly, but they could also file their federal tax return as married filing jointly.

The Windsor case had a lot of consequences for preparers. In places like Massachusets where same sex marriage was legal, then the couple could just file as married filing jointly for both the state and federal returns. But in other states where same sex marriage wasn’t allowed, it was wait and see status while the legislatures battled it out. Here in Missouri, if you can file as married on your federal return, you filed as married on the state return. Next door, in Kansas, you filed as married on your federal return, and single on your state return. Those of us who prepare multiple state returns had to keep up on all of that. It was a headache keeping track of the state rules. Basically, in 2013, we had a flip flop of the tax rules–instead of filing a joint state return and separate federal returns like we did with Massachusetts in 2004, we were now preparing joint federal returns and separate state returns.

So now, with Obergefell v. Hodges I’m back to filing normal returns for everybody in every state. I get to ask normal questions like, “Are you single or married?” And I don’t have to ask, “Are you gay or are you straight?” Because quite frankly, whether you’re gay or straight should have absolutely nothing to do with your tax return.