______________________________________________________________________________

I hear this question a lot, “Why does my tax preparer want to look at my old tax return?” The answer is: Lots of reasons. Let me give you a few examples.

1. Carry forwards: A carry forward is something that was on your last year’s tax return that can affect your taxes this year. A really important one is capital losses. Let’s say you sold some stocks last year at a big loss and couldn’t use all your losses on last year’s return. You get to carry those forward until they’re used up. I once had to amend a bunch of tax returns for a woman with $100,000 of loss carry-forwards. She had never brought her returns to her preparer before. Because the returns went back for more than three years, some of her deductions were lost forever.

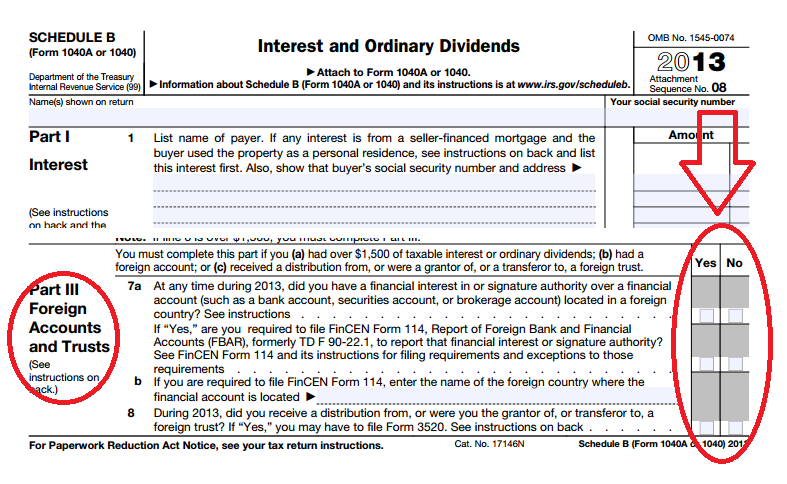

But it’s not just capital losses. All sorts of things from last year can affect this year’s taxes like depreciation, estimated tax payments, what you paid to the state, did you itemize or not, and did you pay any alternative minimum tax (AMT), just to name a few.

2. Continuity: the IRS looks at things funny when you’ve got changes. Changing something simple like putting the wife’s name on top one year, and then putting the husband’s name on top the next can be seen as an attempt to hide something. I always list taxpayers in the same order as the prior year return to avoid trouble. I once helped taxpayers who had a simple notice about their taxes. It was normally an easy thing to fix—make a quick phone call and mail a document and you’re done. What I would call a no-brainer as far as audit letters go. But for this couple, it took weeks to settle the issue; I couldn’t understand the problem. Finally, the agent on the case explained that they were “digging into the taxpayers” because they had flip flopped the names on the return for different tax years, which is a common habit with fraudsters.

Fortunately for the couple had nothing to hide—but a teensy little question on their tax return (not even a mistake, just a question) led the IRS to look back through several years of tax returns because of the flipped names.

3. Finding missed deductions: If you have a professional do your taxes, we want to find a missed deduction. It’s what we do. For us it’s the chocolate sauce on the ice cream. It’s well…., click on this video to see how finding extra money for you feels http://www.flickr.com/photos/83052216@N00/4354753195/in/photolist-7CPfpD-9LYL7p

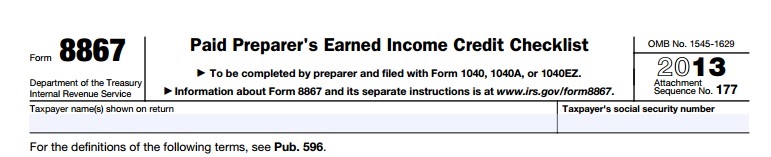

4. Making sure your new preparer doesn’t miss something: I have some clients with some pretty complicated paperwork. They have tax forms that aren’t included in home tax preparation software and aren’t even found in some professional packages. I have to get some of these forms from the IRS and prepare them by hand. (I actually print out extra copies of those forms and tell my clients, “If you ever change preparers, your new preparer needs to see these.”) But even if your tax return is fairly easy, letting your preparer see your last year’s return is a good idea—you don’t want her to miss something.

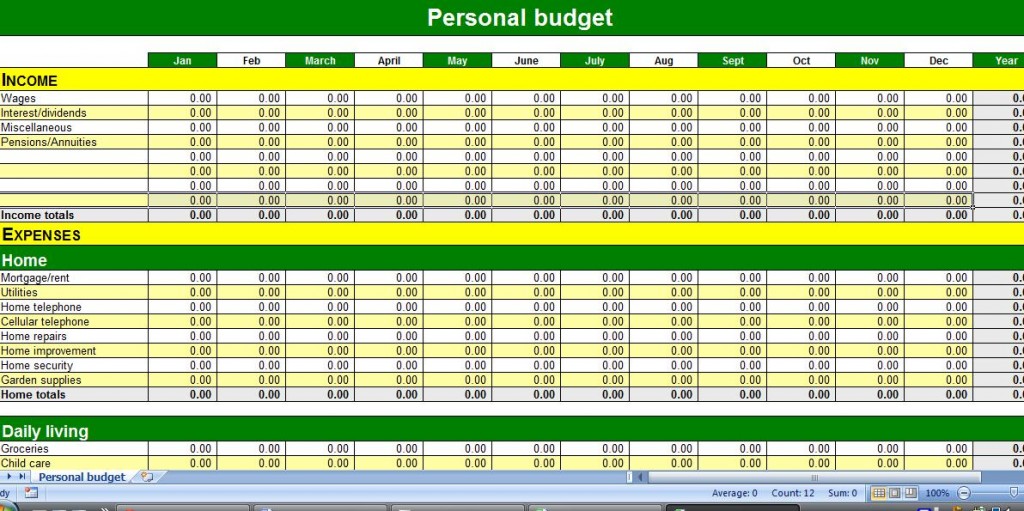

5. Comparison: Putting your tax returns together for comparison purposes is a valuable tool for you. How did you do this year? Did you make more than last year? Did you make less? What did you do differently? What should you do differently? You’ve probably heard the old saying, “Those who don’t study history are condemned to repeat the same mistakes.” The same goes with your tax return.

So please, bring your old tax return with you when you make a tax appointment. It will make your preparer happy and it could save you some money!