SAINT LOUIS COUNTY MISSOURI

ASSESSOR’S OFFICE

41 South Central Avenue

St. Louis, Missouri 63105-1777

314-615-1500

Do you own a small business in Missouri? Are you filing a Schedule C with your 1040 tax return? Or do you have a partnership or corporation? If yes, then you’re supposed to pay personal property taxes on your equipment.

I keep getting asked: Do I have to pay personal property taxes? Do I have to fill out that form? If you own a small business, the answer is yes.

I used to think that if you didn’t have any assets, you didn’t have to do a business personal property declaration. But—even if you have absolutely no business assets at all, you’re going to have a minimum assessed value of business property for tax purposes of $200. That’s not what the tax is, that’s an assessed value of your property.

So how does that assessment thing work? I’ll use my own business as an example. In 2013, I bought new computer equipment. The total cost was around $3,000. Computers count as “5-year” property, because that’s how long it takes to depreciate a computer on your tax return. (Office furniture is an example of a 7-year property.) Now I’m writing off the whole cost of the computer on my tax return (as a Section 179 expense)—but it’s still considered a 5 year property for depreciation purposes and for the personal property tax declaration.

In the personal property tax declaration form, I would put $3000 for year 2013 in schedule 9 for 5-year property. (If your brain just exploded reading that, relax, I’m going to give you the easy cheater way to do the form in a little bit.)

Then that amount (in my case $3,000) is multiplied by .85 and then multiplied by .3333 so my assessed value is $849.92. That’s not the tax I’m going to pay, that’s just the assessment of the value of what my business owns. (3000 x .85 x .3333 = 849.915)

Last year, the tax rate was 8.052. I only had $230 of assessed value so my bill was only $18.52 this past December. Because of my new equipment, my bill will be higher this year. But your bill is going to be close to 8% of what the assessed value of your equipment it. As your equipment ages, the assessment will go down but the assessment will never go below $200.

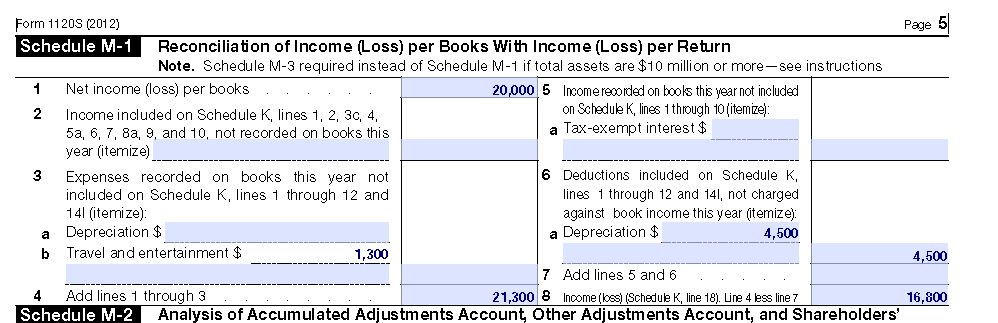

So what’s the cheater trick for filling out the form? Grab your tax return and pull out the Federal depreciation schedule. It’s going to have a list of your company assets, what they cost, and whether they are a 5-year, 7-year, or a 10-year property, and what year you bought them. If you have company assets like computers, equipment, or vehicles, then you should have a depreciation schedule to go with your tax return. I know that some companies won’t give that list to their clients to force them to come back every year. If you’re not getting that list—you have a right to ask for it. (And move to a preparer that gives you all the information you need for your taxes.)

If you didn’t get your personal property tax declaration statement in the mail, here’s a link so you can have the form:

http://www.stlouisco.com/Portals/8/docs/document%20library/Assessor/pp/BusAndMfgDecForm_WebCopy.pdf

You need to have it signed and filed by March 31st.

St. Louis County has started a new Online Personal Property Declaration that will be available from February 1 – April 30th. http://revenue.stlouisco.com/Collection/ppInfo/ppDec.aspx It’s a good option for people who missed the March 31 deadline and for people who are just more comfortable with on-line services. If you start using the online service, you’ll be able to access your previously filed returns, making it a whole lot easier to fill out that form in the future!

If you’ve been forgetting to file your St Louis County personal property taxes, 2014 is a good year to come clean and start filing.