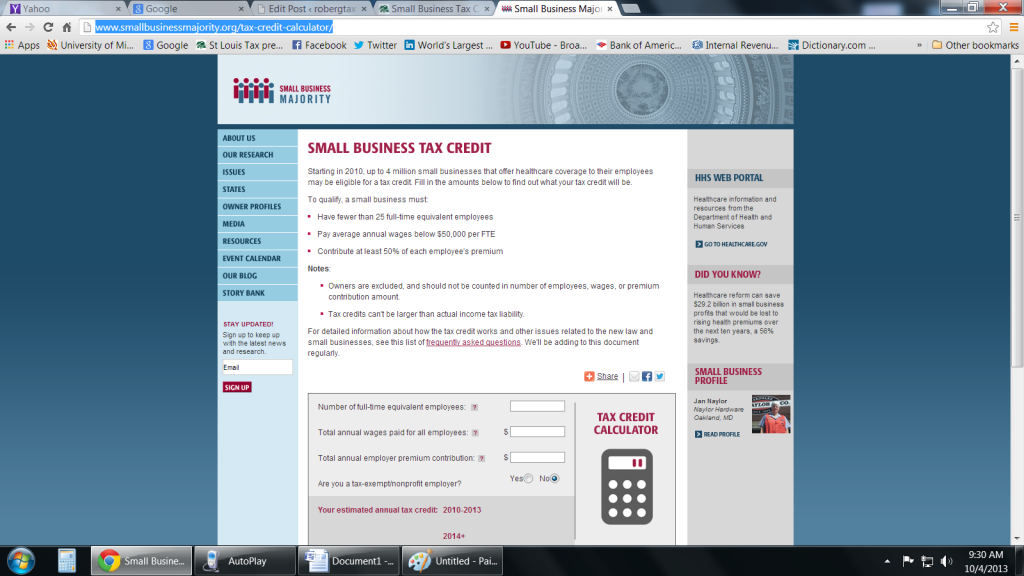

http://www.smallbusinessmajority.org/tax-credit-calculator/

“Starting in 2010, up to 4 million small businesses that offer healthcare coverage to their employees may be eligible for a tax credit. Fill in the amounts below to find out what your tax credit will be.

To qualify, a small business must:

Have fewer than 25 full-time equivalent employees

Pay average annual wages below $50,000 per FTE

Contribute at least 50% of each employee’s premium

Notes:

Owners are excluded, and should not be counted in number of employees, wages, or premium contribution amount.

Tax credits can’t be larger than actual income tax liability.

For detailed information about how the tax credit works and other issues related to the new law and small businesses, see this list of frequently asked questions. We’ll be adding to this document regularly.”