Photo by redjar at Flickr.com

The first question I’m always asked when someone receives an audit notice is, “Why me? What’s wrong with my tax return?”

If you received an audit notice, that’s a perfectly legitimate question, and you have the right to ask. It’s a very important question too. The answer you get from the IRS can help you to limit the scope of the audit—that‘s really important. If you know what the audit is about, you know where to focus your energies.

Often times, an IRS agent may respond with, “Oh, I don’t know why your return was pulled, it’s just a random audit.” However, sometimes they don’t seem so “random”. Actual random audits (and yes, they do occur) involve reviewing every single line item on the tax return. They’re used to help determine how future audits are handled. Most audits, are not random, and if you’re being audited you have the right to know why.

So what does trigger an audit? The most common type of audit is called a correspondence audit. Usually what happens there is that the IRS received a notice saying you received income from a source and it doesn’t match anything on your tax return. They call it “document matching.” (Hey, it’s the IRS; creative names are not their forte.)

Document matching audits are usually pretty simple. For example, the IRS gets a W2 from a job you had for 2 weeks in January but you completely forgot about it at tax time. You never got the W2 so you didn’t include it on your return. That’s a fairly typical correspondence audit. In a case like that you just sign the form and pay the tax. That’s a simple “oopsies.” You’re not a criminal, you just made a mistake.

Sometimes, document matching is kind of screwed up. For example: I just handled one where the document matching showed three interest statements for “First National Bank”; one for $21, one for $16, and the third for $54. The tax return showed interest for “First National Bank” as $91 ($21 + $16 + $54 = $91). We just handled that with a phone call. Document matching is done by computer. Normally, a human would have caught the numbers added together and the audit letter would never have gone out, but the computer isn’t that sophisticated.

One of the best ways to prevent document matching audits is to make sure that you report everything on the correct line. If you have a 1099 with an amount in box 7 and you don’t have a Schedule C with your tax return—that will generate a correspondence audit. Another common correspondence audit involves capital gains. If you’ve bought or sold stocks or had stock options through your job—there should be a Schedule D with your tax return.

If you’re dealing with something new in your taxes, even if you’re very good at preparing your own, I recommend at least having a second look done before you file.

In-person audits are more often based on statistical data. The IRS uses something called a “DIF” score. To put it in simple terms, a DIF score basically highlights when things on your tax return are out of the “normal” range. Basically, a computer algorithm kicks out something like: “Joe Schmoe’s charitable contributions are out of line with his income. So Joe will be audited for his charity donations.

So how do you know what’s normal? That’s the magic question isn’t it? The IRS does not release its DIF score formulas. Even if they did—if you have a legitimate deduction, you shouldn’t let DIF scores (or the threat of DIF scores) keep you from claiming what’s legitimately yours.

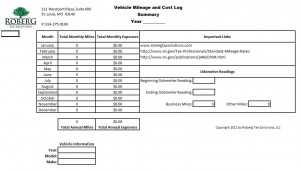

I once worked on an audit for a fellow whose return was being looked at for the mileage he claimed. In truth, his actual mileage was much higher than what he reported, but his co-workers had convinced him that he shouldn’t claim all his mileage because he’d get audited. Claiming the lower mileage didn’t protect him from an audit—and—it cost him money for all those years that he didn’t claim what was rightfully his.

Your best defense against an audit is always going to be doing your taxes right in the first place and having the documentation to back up your claims.

If you’re a W2 wage earner, the most likely audit area will be your charitable contributions and employee business expenses, because most everything else can be determined through document matching.

Small business owners (Schedule C) are much more likely to be audited—mostly because there’s so much more to audit. In every Schedule C audit I’ve ever worked on, the IRS has requested the mileage log. Every audit—mileage log. Every single one.

In addition to the mileage log, they’ll often want to examine the expenses or the revenues, sometimes both. If you own your own business, I can’t stress enough the importance of keeping good records.

If you’re being audited, the IRS agent should be able to tell you why. If you honestly don’t know why you’ve been selected, and you’re not getting clear answers from the IRS, hire someone to represent you. A professional can usually find the audit trigger (or triggers) within a matter of minutes.