I’ve you own your own business and provide service to another company, they may ask you to fill out a W9 form.

If you own a business and you pay for services to an individual, and you expect to pay over $600 for those services, then you should have that person complete a W9 form for your files. You’ll need the information in order to prepare the 1099MISC forms next January. Also, you only need a W9 if someone is working for your business. For example: when I have Brad the Painter come to my house to replace my damaged siding—I don’t give him a W9, it’s a personal service to me. Now if I hired Brad to paint my office, then I’d have to collect the W9 because it would be a business expense.

The general rule here is if you’re writing the service off as a business expense, then you’ll need to collect a W9 from the vendor.

Who should I give a W-9 to? This is an important question because I received numerous complaints from people who were asked to complete a W9 form. Basically, if you’ve done work for a business and they’ve paid you over $600 you should just hand them a completed W9. That was the instruction I was given by the IRS for my own company. You might think you’re not self-employed, or that you don’t have a business—but if you are doing work, getting paid, and not on the payroll; that means you’re self-employed.

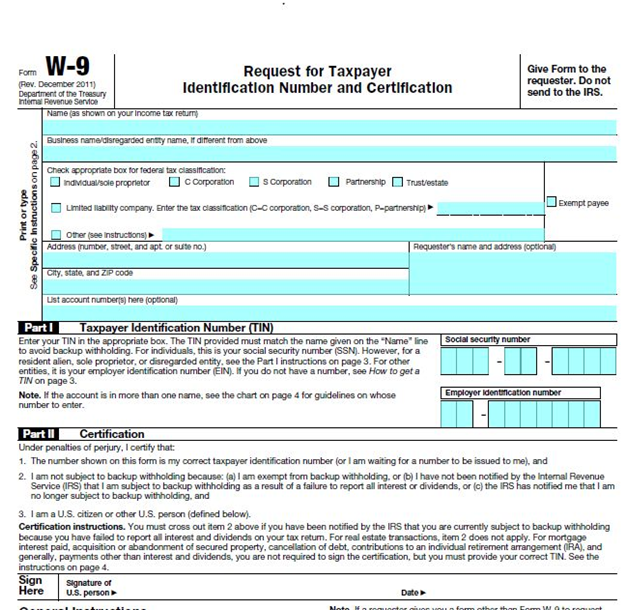

When you look at the W9, the check boxes indicate if you’re an S Corp, C Corp, or sole proprietor. The instructions also recommend that sole proprietors use their social security numbers instead of EIN numbers. This is where I’m going to disagree with the IRS, in light of the huge number of identity theft cases this past year, do not use your social security number on your W9 form. Anybody can get an EIN number for their business. You can do it for free and it takes about 5 minutes at the IRS web-site: http://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Employer-ID-Numbers-(EINs)-

When completing the EIN application, a sole proprietor is anyone who is filing a schedule C (self employed), E (rental real estate) or F (farm) for their business. It’s important to know that the minute the IRS issues the EIN number, it’s good. If you have to submit a W9 but don’t have an EIN, you can go online, get the EIN, and use it on your W9. The business issuing you a 1099 must accept your EIN even if you did the work a year ago.

Is there any way to avoid having to complete a W-9 form or issue a 1099MISC? The easy way to avoid having to issue a 1099 MISC (and collecting a W9 form) is to pay by credit card. Credit card companies are now issuing 1099K forms so that revenue to the vendor is already being reported to the IRS by another reporting agency. If you don’t want to be collecting W9 forms and issuing 1099s, then use your credit card. This is the easiest way to avoid 1099MISC and W9s, but remember that there are lots of fees associated with using credit cards. As my Mom used to say, “Pick your poison.”

What about home office expenses? Do I need to collect a W9 from my landlord? I think this is a case of the overzealous W9 collector. If you have a home office, you’re reporting that on your Form 8829. Whether you are reporting mortgage interest or apartment rent, it is considered to be a personal expense that you are attributing a percentage of to your business expenses. You do not need to collect W9s from your mortgage company, landlord, or utility companies to claim your home office deduction. (I’ve been asked this question enough times that I felt it necessary to include it here.)

What about purchasing an item from an individual? Do I need a W-9 then? The example that was given to me was buying a claw foot bathtub from Aunt Bertha. I tend to think of this kind of like going to a garage sale—you wouldn’t dream of giving a 1099 to the person running the garage sale would you? Now if Aunt Bertha were in the business of refurbishing bathrooms; that might be another story. But if you just buy something, a private transaction between two people, that’s not a W9 issue.

What about small jobs that are repeated monthly so the total will be over $600. Do I need to get a W-9 for those? Once again, if you’re talking about business expenses then you should collect a W9 and issue a 1099MISC for the work. For example: I used to pay $50 a week to a guy to edit my blog posts and monitor my website. (Now Mike does that.) Although the payment was only $50, over the course of a few months, it exceeded the $600 threshold so I had to issue a 1099.

Generally, if you’re unsure about needing a W9, it’s safer to err on the side of collecting one and issuing a 1099MISC than it is to not have it.

Hi Carolyn,

If you’re just a regular homeowner, you do not need to issue a 1099MISC to your painter. A business owner, hiring a painter to paint a business office – that would be a different story. Or, let’s say a business owner, who also happens to own a home, hires a painter to paint her house, – well that’s just a personal transaction, not a business transaction, so no 1099MISC.

I am paying a painter $1,100 to paint my house. Am I, an individual, required to get W-9 and send him a 1099 Misc?

Well yeah, but with all the identiy theft, I don’t blame people for not wanting to give out their socials. That’s why getting an EIN for business is so important.

#1 objection to requesting a W-9: people don’t want to give me their Social Security number. Perfect response to such persons: “No problem. You don’t need to give me that information… unless you want to get paid.”