At first blush, you might think that advertising and charity don’t go together at all. But when you own a small business, your advertising and charity might just go hand in hand. Let me explain.

When you own a small business, you’ll get lots of calls from organizations wanting your business to make donations to charities. When you’re a sole proprietor, partnership, or S Corporation, your charitable donations don’t reduce your business income, they only count as a charity donation on your Schedule A personal tax return.

So—let’s say you want to donate $100 to Cystic Fibrosis from your business. That’s all fine and good, but that donation doesn’t reduce your business income by $100. It doesn’t reduce your business income by anything at all. You still get to deduct it on your Schedule A—but if you don’t itemize your deductions, that $100 donation doesn’t help your tax return at all.

This is where advertising comes in. Instead of just donating $100 to a charity, you can buy an ad in a charity event program, that way you’re giving money to the charity, and getting a 100% business write-off for the advertising. The charity still gets your money, and you get a better write-off.

Why do you want to your business donation to be advertising? The taxes! If you have a sole proprietorship and you’re in the 25% tax bracket, your business income is actually taxed at 40.3%. (25% regular tax rate plus 15.3% self employment tax.) If you itemize your deductions, your $100 donation would really only cost you $75 (but only if you can itemize your donations.) But if you can count it as a business expense, then your $100 donation would really only cost you $59.70. ($100 minus $40.30) See why this is a good thing?

Of course, there are some things that are just going to be charitable donations no matter how you try to align them. Your tithe or temple dues simply won’t count as advertising. But when you’re looking at charities that you like to support, be sure to check out the advertising opportunities.

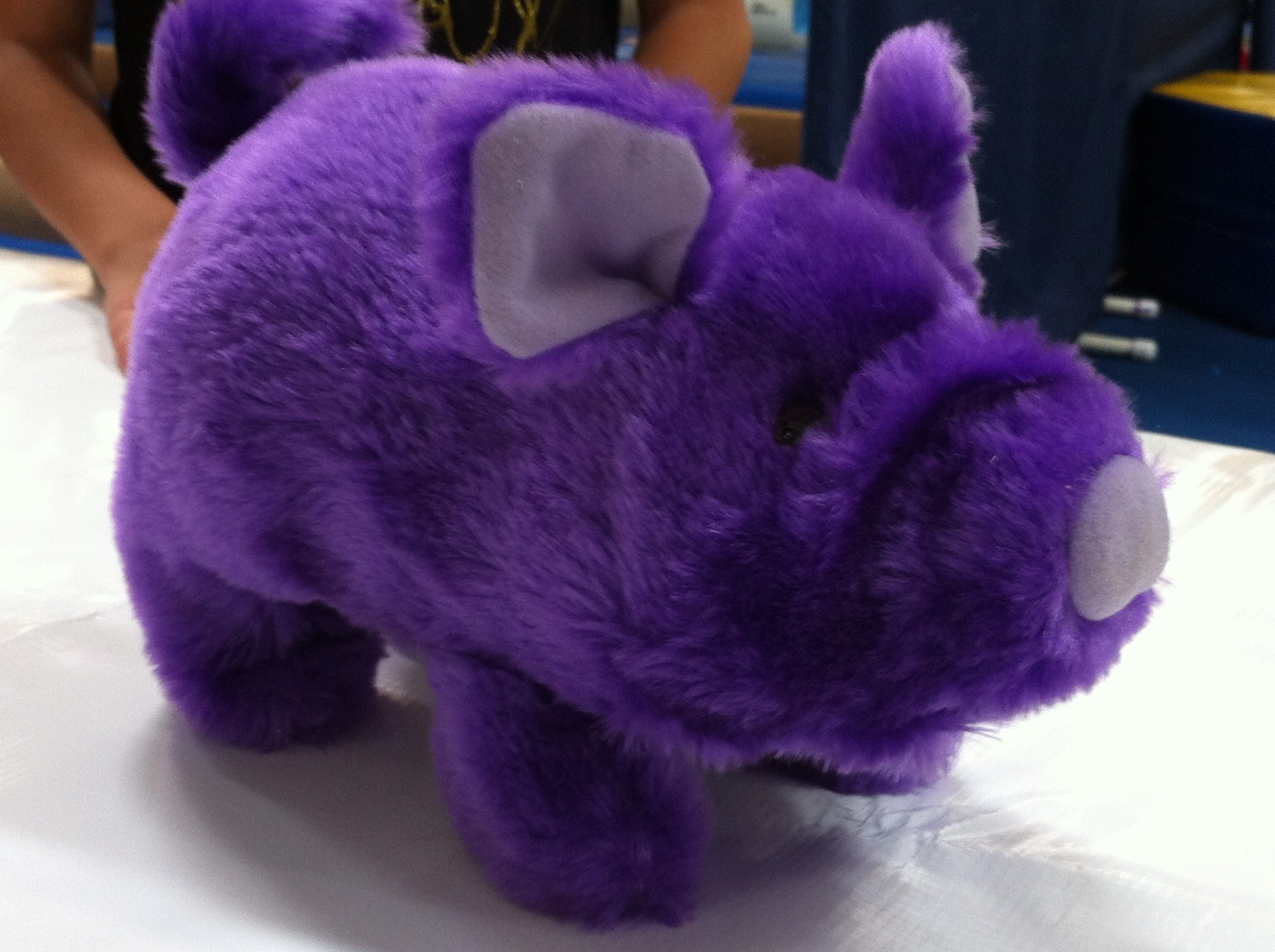

So what’s with the purple pig? A not for profit I support held an event for kids. Instead of just donating money, I got to set up a booth and hand out my fliers to the parents. The pig was part of a pig race game for the kids. The pig is a 100% deductible business expense—and he’s really cute. Cute and deductible—that works for me.

Hi Steve,

I really like a website called The Bradford Tax Institute.

I put a link to an article about making charity a deductible business expense. You can get a free subscription to the site for 30 days. It’s pretty fun. That said, the court case he quotes for counting the percentage of sales going to charity as a business expense is a 1954 Supreme Court Case: Robertson v. US. I’m not feeling like that court case is the be all end all substantiation that you’re looking for. I honestly thought I had the wrong link when I found it.

Bradford quotes IRS revenue ruling 55-514, but I can only find a copy of it on the Bradford web-site.

So it’s probably not as definitive as you’d like, but it’s all I’ve got.

Jan

What are your thoughts on S corp that donates 10% of sale proceeds to charity based on various promotions. For instance widget A is being promoted this week and 10% of proceeds go to charity ABC. Next week it might be widget B with 10% going to Charity DEF. Last year it was a significant amount that was given away thru these promotions but the Company is clearly trying to use this as a sales tool with the charitable purpose being secondary.

They make enough money that the charitable deduction is partially lost. Do you have any definitive guidance on this topic as I have not come up with any.

Hi Tom, I like your idea. I just paid $250 for advertising at a golf tournament for one of my favorite charities. They called it buying an ad. But to be honest, I wouldn’t buy the ad if it wasn’t a charity that I really like.

Hello Jan,

I’m wondering if the way it’s promoted has a lot to do with it. When our (charity) partners sign up, it’s clearly defined in the contract we are buying advertising and advertising services from them. And on our site, for example, we are considering utilizing this kind of a description:

Supporting causes you choose is what we do. We utilize approximately one third of our revenue to buy advertising from community groups.

Local school clubs, volunteer fire departments, and community organizations struggle to keep things going. Their advertising efforts inviting you here generates revenue for them.. etc., etc., etc.

What do you think?

Hi Alana,

I like that idea, but I think that’s going to be a solid charitable donation because you’re saying it’s a charitable donation. While yes, you hope it brings you more sales, you advertised the $5 as being a straight donation to the charity–so I’m sorry I don’t think that would fly.

I’ve been mulling this over for awhile now, but I’m still not finding a way to make it work. Sorry.

Thanks for the info! This is exactly what I’m wondering. I am an author. If I advertise that I give $5 per book sold to a certain charity, would it be appropriate to count that $5 as a business expense, since I’m using that as a means to hopefully garnish more sales? Could this count as an advertising expense?

Hi Leandra,

The pigs come from a place called American Carnival Mart. The store is here in St. Louis. They also sell things online. Here’s a link to the pigs: http://www.funcarnival.com/Merchant2/merchant.mvc?Screen=PROD&Product_Code=M435

The pigs were really popular with the kids. I hope your daughter likes hers.

Great article. Love the Pig! My 3 year old daughter has a pig collection and since her favorite color is purple, this would be the BEST gift!!! Do you know where I can get one like this??? Do you have one/any left?? Thanks, Leandra