When deciding if you should elect Sub-chapter S corporation status for your company, you need to run the numbers first!

Electing to be taxed as a Subchapter S Corporation instead of as a Sole Proprietor could mean big tax savings for you as a small business owner. Notice I said could–because it’s not always the case. It’s really important to run the numbers – all the numbers – and do a comparison so you can make an informed decision.

This post is going to be a little technical. I apologize for that up front. I’m going to try to keep it in plain English though, because even if you can’t run the numbers yourself, you need to see what I’m talking about so you can discuss this with your accountant.

Here’s an example where I think choosing to be a Sub S Corporation is the right choice for a business owner: Jack Sparrow is a single, self employed pirate with net self-employment income of $100,000. (Yes, Johnny Depp was on TV last night.) Jack has no other income to report on his tax return.

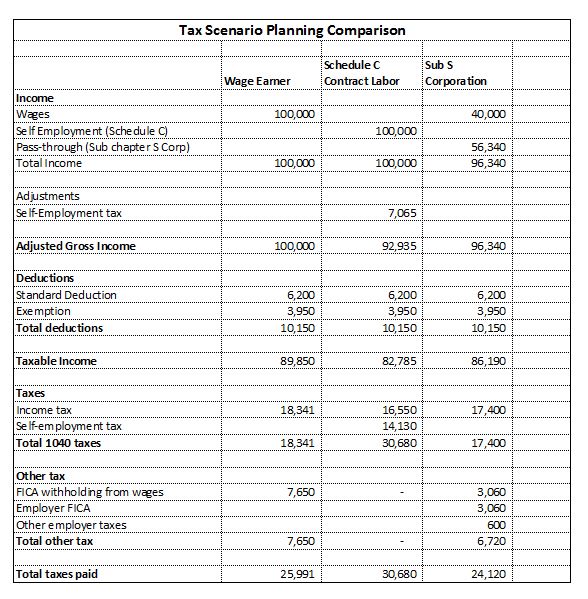

I ran the numbers for 2014 and it shows the total tax on the 1040 return to be $30,680. ($16,550 for the income tax and $14,130 for the self employment tax.)

That’s a lot of taxes!

But what if Jack were to set up a Sub Chapter S Corporation? He’d have to set himself up to receive payroll–(that’s part of the deal with an S Corporation, you have to pay yourself a salary) but the rest of his income would be taxed at his regular tax rate (they call that ordinary income) instead of at the self employment rate.

So for my example, I set Jack up with a payroll of $40,000, his S Corp income is $56,340 (not $60,000 because he’s paying some payroll taxes that are deducted.) So when I run the taxes for that, I’m showing that his total tax on his 1040 is $17,400.

Right here you’re probably going, “$13,280 in tax savings per year? Awesome! Sign me up now!”

But it’s not that simple. Because remember, part of being an S Corporation means that you must set up a salary for yourself and pay the payroll taxes. If you don’t include the cost of those payroll taxes in your calculations, you’re not giving yourself a true comparison of the total tax cost.

For Jack’s example, we set up a payroll for $40,000. From his $40,000, Jack will have $3,060 withheld as his employee share of FICA-that’s the Social Security and Medicare tax that gets withheld from everyone’s wages. Also, remember when I said his S Corp income was $56,340 instead of $60,000? That’s because as an employer, Jack also had to pay an additional $3,060 for the employer’s share of FICA, and I added another $600 for state and federal unemployment taxes. The unemployment tax will vary by state but $600 is a reasonable estimate.

When you add those payroll tax costs to the 1040 tax cost, Jack’s total S Corp taxes are now $24,1120. That’s still a big tax savings of $6,650! In this case, of course I would recommend that Jack go for the S Corp.

Just for fun, what if Jack were offered a pirate job as a wage earning position? All W2 income with no self-employment at $100,000 per year? Just running the numbers straight like that, his 1040 taxes would be $18,341 and his FICA withholding would be $7,650 so his total tax cost would be $25,991 which turns out to be $1871 more than his S Corp taxes.

Now in real life, there would be other considerations – like health insurance and other fringe benefits that might make Jack want to jump at that wage position. But I left all of that out for this comparison.

The chart at the bottom of the post shows the numbers for Jack’s case side by side so you can see how I got to my numbers, in case you want to replicate them for yourself.

So, how do you determine if YOU should have an S Corporation instead of a sole proprietorship? You look at these numbers and it’s pretty persuasive. If you could save $6,000 or more a year, who wouldn’t do that? But taxes have a lot of moving parts these days. Maybe you have investment income, maybe you have wages from another job. Maybe you have deductions that are allowed on a Schedule C that aren’t allowed for an S Corp. Healthcare costs can also make a difference and so can your retirement savings goals.

If you don’t run the numbers fully through a tax program, including the payroll tax costs, you could actually lose money going with an S Corp. I ran a scenario the other day – this is a real person’s actual numbers: her tax savings by converting to an S Corp–before adding in any payroll taxes, was only $1,338. She’d spend that much in accounting fees for the payroll and additional tax return. Adding in the FICA and employer payroll taxes we send her to the loss column. I never would have known that had I not sat down and ran the numbers based on her whole situation.

While that taxpayer’s situation was unique, your situation is also unique to you. Before electing to be an S Corporation, make sure you have all the facts and run all the numbers. You’ll be glad you did.

Here’s that chart I promised you:

Great, thanks, this is what I was looking for.