Individuals and corporations (as well as income from estates and trusts and estate and gift transfers) are all subject to taxes pending the presence of taxable income. Among one of the numerous benefits with budgeting is planning for the impact of these taxes. But first let’s look into why certain entities do and do not budget.

In a corporate setting, budgeting is a necessary part of the accounting system and managers often receive pay increases if production is within budget. Also, budgeting is imperative in corporations in order to stay current with the ever changing government regulations and to keep up with the current industry competition.

What about the small business level? Do you like to stay up late and write up budgets and proforma financial statements? Not everyone does. And in my opinion, not everyone has to. Jan and I have seen many successful small businesses who do not write up formal budgets for their businesses. It’s your choice but I am not against them whatsoever. Of course, the bigger your company is getting, the more likely you will want or even have to start creating budgets.

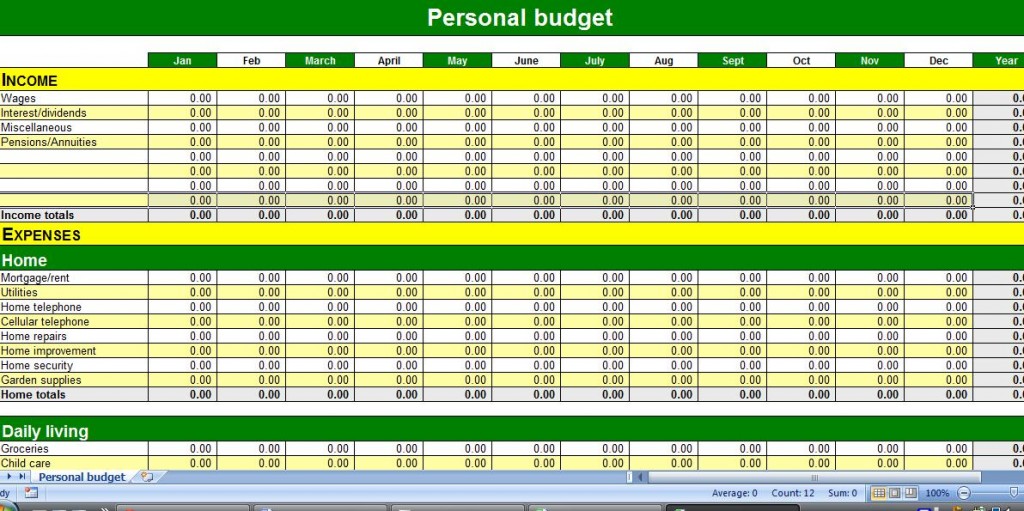

And you? Do you have a budget? Not your small business, not your S Corp, not your partnership, but YOU? Personal budgeting for some can be worse than going to the dentist. If a template is all that is holding you back, we have a free one in this blog and in the downloads tab on top of the website. This budget template has a very clean presentation and is nicely detailed. I am certain that you will like it.

RTS Personal Budget – Click to Download

My point with this blog was not to tell you that budgeting will solve all of your problems and that once you create the perfect budget, the weight of the world will be lifted off your shoulders—although for some people it will. Making a budget is not imperative for your success – many Americans alike get up and go to work everyday, make a modest salary, and support a family with discretionary income leftover all without ever touching excel. Where am I getting at? If you don’t have a reason for making a budget, then you simply won’t. Money is different things to different people – a blog post in its own—and some people do not care to know how much money they are making on a monthly basis.

However, what about the gentleman who finds himself with enormous tax debt and needing to do an offer in compromise with the IRS? To do that, he has to do a 433-A (OIC) which asks you to provide monthly income and expenses–essential a monthly budget.

Will creating a budget reduce my taxes? Not necessarily. Whether you make a budget or not, your income will always be subject to taxes. However, it does help plan your tax liability and gives you a more accurate picture of what your taxes and tax bracket could be given accurate estimates.