With all the questions the IRS requires tax preparers to ask, getting your taxes done can seem more like an interrogation than tax prep.

I took a phone call from a fellow awhile back who was absolutely furious about some of the questions his tax preparer had asked him. The preparer had asked a whole bunch of questions about his kids and even asked to see their report card from school. He said, “My daughters are 4 and 2 years old. They don’t even go to school yet!”

So what’s going on here?

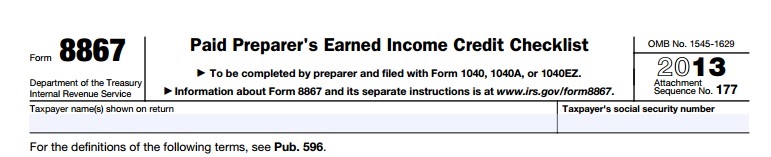

It’s all related to an IRS form—# 8867. Form 8867 has to be filled out and sent in with every tax return that has the Earned Income Tax Credit. Now, this form has been around for awhile, but it used to be that a tax preparer was just supposed to ask some questions and you’d keep that information to yourself. Now, the IRS expects you to send the form in with the tax return. If a tax preparer doesn’t complete the form and send it in with an EIC return—the IRS charges a $500 penalty to the tax preparer.

That’s $500 per return. You miss too many of those and you could be out of business. For most preparers, that’s more than what we charge to prepare an EIC return.

Now if you prepare your own tax return, you don’t have to worry about form 8867, it’s only for paid tax preparers. But if you have your taxes done at H&R Block, or Jackson Hewitt, or even me—that form must be completed, and signed, and sent with your tax return. (If your tax return is e-filed, we are required to keep the signed copy in our files.)

And the form seems to ask for more and more information every year. Now there’s a whole section about documents: documents to prove your kids live with you, documents to prove a disability, and documents to prove self-employment income. Tax preparers are now expected to look at a taxpayer’s documents to verify the information on an EIC tax return. School records, like report cards, are usually the easiest thing to use for documentation. Of course, report cards aren’t very helpful when your children aren’t in school yet. No documents, no form 8867. No form 8867, no tax return. No tax return, no refund.

It’s like the IRS is trying to turn regular tax preparers into the EIC police. It’s not a job we asked for, but it’s a regulation that we’re required to enforce. The penalties are so stiff that we’ll all be out of work if we don’t go along.

So remember, if you tax preparer asks to see your child’s report card, he doesn’t care if your son got a D in math or is a straight A student; he’s just trying to help you get your refund.